Gold has been attempting recovery after tumbling below the round $1,800 level on Friday. So far, the precious metal seems to have failed and is falling alongside the dollar and stocks as November is ending. Some of the moves may be attributed to end-of-month flows.

How is XAU/USD positioned once the dust settles?

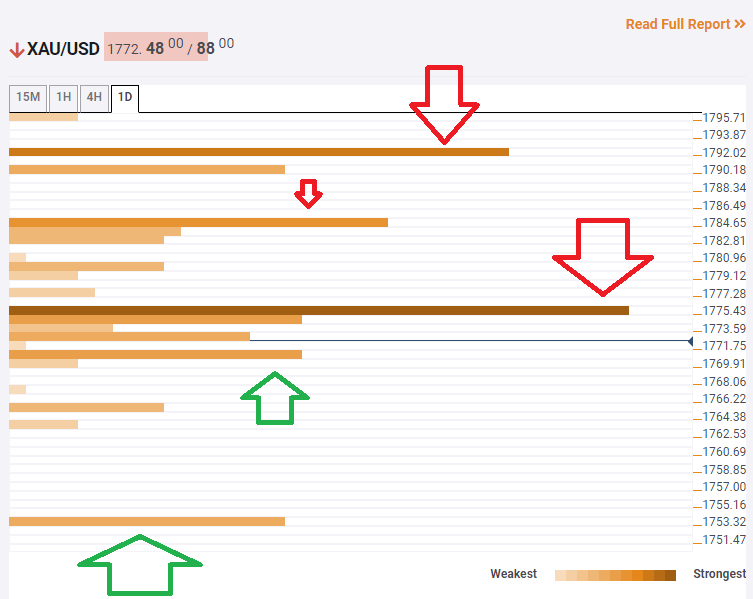

The Technical Confluences Indicator is showing that critical resistance awaits at around $1,775, which is the convergence of the previous daily low, the Pivot Point one-day Support 3 and the Bollinger Band 1h-Middle.

Further above, the next hurdle is $1,784, which is a juncture including the BB one-day Lower and the Fibonacci 23.6% one-day.

The upside target is $1,792, which is the meeting point of the Simple Moving Average 10-4h and the BB 1h-Upper.

Some support is at $1,770, where the Pivot Point one-day Support 3 and the previous 1h-low converge.

Bears eye $1,753, which is where the Pivot Point one-day Support 2 hits the price.

Key XAU/USD resistances and supports

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence