- Gold takes the bids near multi-day top, rises for fourth consecutive day.

- Sustained break of 50-day SMA, risk-on mood favor bulls, sellers have multiple barriers to entry.

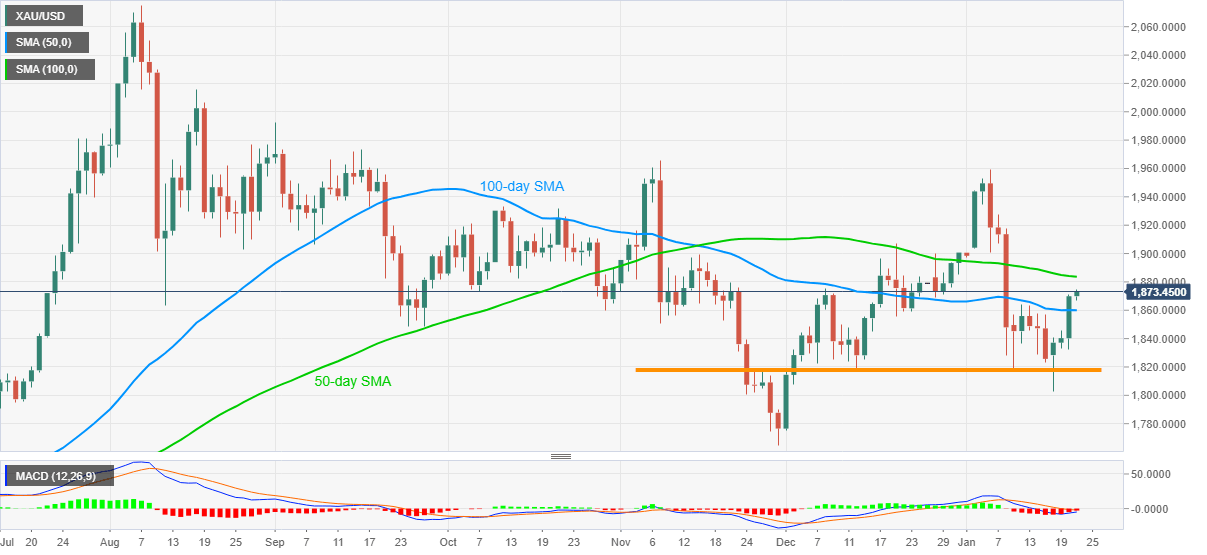

Gold prices rise to the fresh high since January 08 while taking the bids near $1,875, currently up 0.17% near $1,873.50, while heading into Thursday’s European open. The yellow metal buyers cheer successful upside break of 50-day SMA to refresh the multi-day high.

Additionally, the market’s risk-on mood due to US President Joe Biden’s formal ruling for one day and the receding strength of the MACD’s bearish signals also back the upside momentum.

Against this backdrop, the bullion currently rises towards 100-day SMA, at $1,883.80 now, a break of which will eye for the $1,900 round-figure and December top near $1,906.

Meanwhile, any pullback moves need to drop beneath the 50-day SMA level of $1,860 to recall even a short-term gold seller.

Also challenging the quote’s downside are two-month-old horizontal support, $1,818/17, the monthly low of $1,802.80 and November’s bottom close to $1,764.

To sum up, gold’s recent upside break of the key SMAs join broad market optimism to recall the buyers.

Gold daily chart

Trend: Bullish