- The rise in Asian stocks knocks-off Gold.

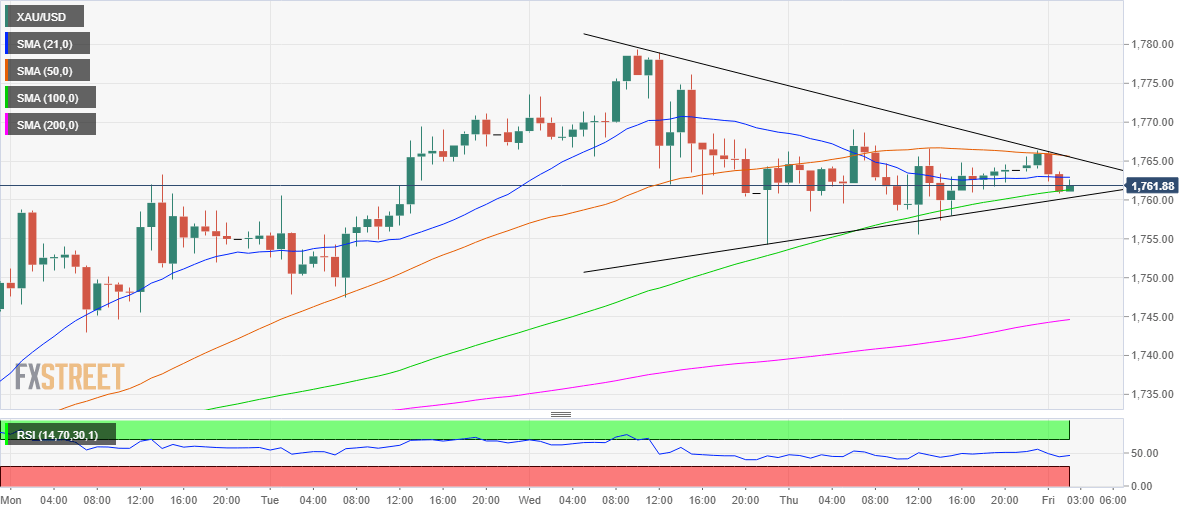

- Range-play intact while within a symmetrical triangle.

- A break above $1766/67 is needed for the further upside.

The overnight recovery in Gold (XAU/USD) stalled once again near the 1766 region, as the Asian stocks rallied, tracking the late gains on Wall Street, which dulled the allure of the safe-haven.

Reversing from higher levels, the yellow metal flirts near-daily low of 1760.86, at the time of writing. The spot is down 0.15% so far.

Technically, the price trades within familiar ranges within a potential symmetrical triangle pattern on the hourly chart, with the risks skewed to the downside so long as it stays below the horizontal 50-hourly Simple Moving Average (HMA), now aligned at 1766. That hurdle is a tough nut to crack, as the falling trendline resistance coincides there.

The hourly Relative Strength Index (RSI) trades flat just below the mid-line, suggesting that the bearish pressure still persists.

Should the bulls manage to clear the critical 50-HMA barrier, the triangle breakout will get confirmed and the 1800 level will be back on the bulls’ radar.

Alternatively, the rising trendline resistance at 1760 could limit the downside, as the pair tests the bears’ commitment around 1761 (100-HMA), where it now wavers.

A breach of the 1760 level will validate the triangle breakdown, opening floors for a test of the upward sloping 200-HMA at 1744.62. Ahead of that support, the 1750 psychological level could be put to test.

All in all, the bulls need to clear the 50-HMA for the further upside in the near-term. Focus shifts to the US personal income and spending data for fresh trading impetus.

Gold: Hourly chart

Gold: Additional levels