- Gold remains poised to test the critical $1850 level.

- Risk appetite has downed the USD, lifting XAU/USD to weekly tops.

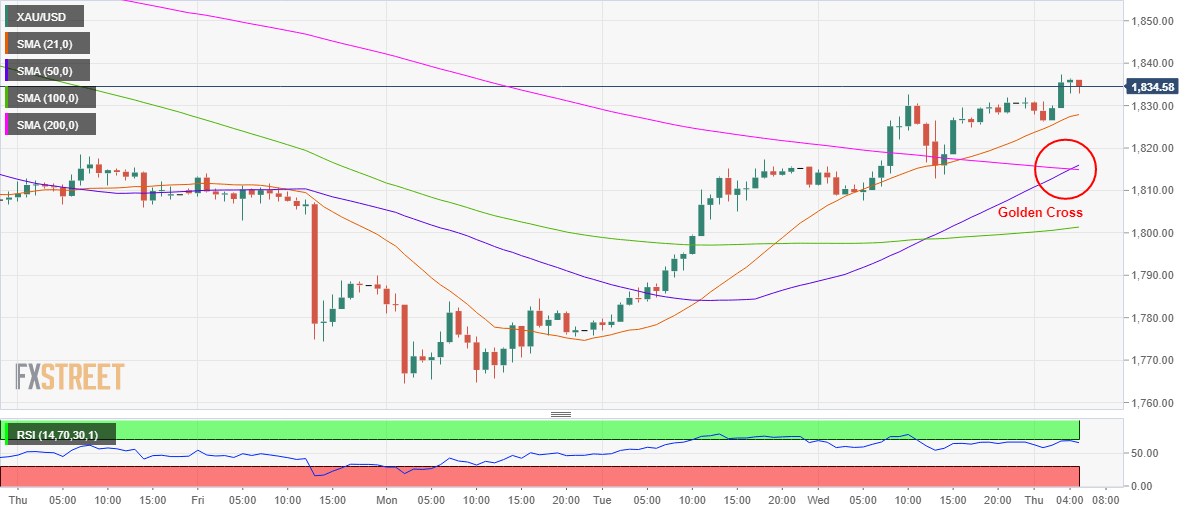

- 1H chart confirms a golden cross, with RSI in the bullish zone.

Gold (XAU/USD) gains further ground heading into the European open, sitting at the highest levels in a week at $1837.

The bulls continue to cheer the renewal of the US fiscal stimulus talks, with a much larger than the previously proposed aid package likely on the table for Congress.

Meanwhile, a softer US ADP print combined with coronavirus vaccine-driven economic optimism continues to pressure the greenback, rendering gold-positive.

Gold Price Chart: Technical outlook

Hourly chart

From a near-term technical perspective, gold has confirmed a golden cross formation on the hourly chart, where the bullish 50-hourly moving average (HMA) cut the downward-sloping 200-HMA from below.

The bullish crossover opens doors to the further upside, with eyes set on the $1850 level, the previous long-held support now a powerful resistance.

Ahead of that level, the November 24 high at $1839 could be tested.

The hourly Relative Strength Index (RSI) has turned south but still holds well above the 50 level, currently at 64.30, allowing for more gains.

Meanwhile, the first line of defense for the bulls is seen at bullish 21-HMA at $1827, below which the $1815 cushion could be tested.

Gold: Additional levels