- Rising Treasury yields outweigh the DXY’s sell-off, weighing on Gold.

- XAU/USD remains poised to test the 100-HMA support.

- Recapturing the 50-HMA Is critical to negating the downside bias.

Gold (XAU/USD) remains under pressure for the second straight session on Tuesday, looking to extend Monday’s correction from seven-week highs of $1790.

The spot currently trades 0.15% lower at $1768, having hit a two-day low of $1765 in the last hour.

The sentiment around the non-yielding gold remains undermined by the ongoing recovery rally in the US Treasury yields across the curve amid a revival of the reflation trades. The benchmark 10-year US rates are back near the 1.63% mark, up 1.60% on a daily basis.

Successful covid vaccine campaigns worldwide combined with the US infrastructure stimulus hopes boost expectations of faster economic recovery, driving the returns on the market higher.

Meanwhile, the persistent weakness in the US dollar amid the economic optimism helps slow down the decline in the USD-denominated gold. However, the technical setup remains in favor of the bears in the near term, which keeps the metal under pressure.

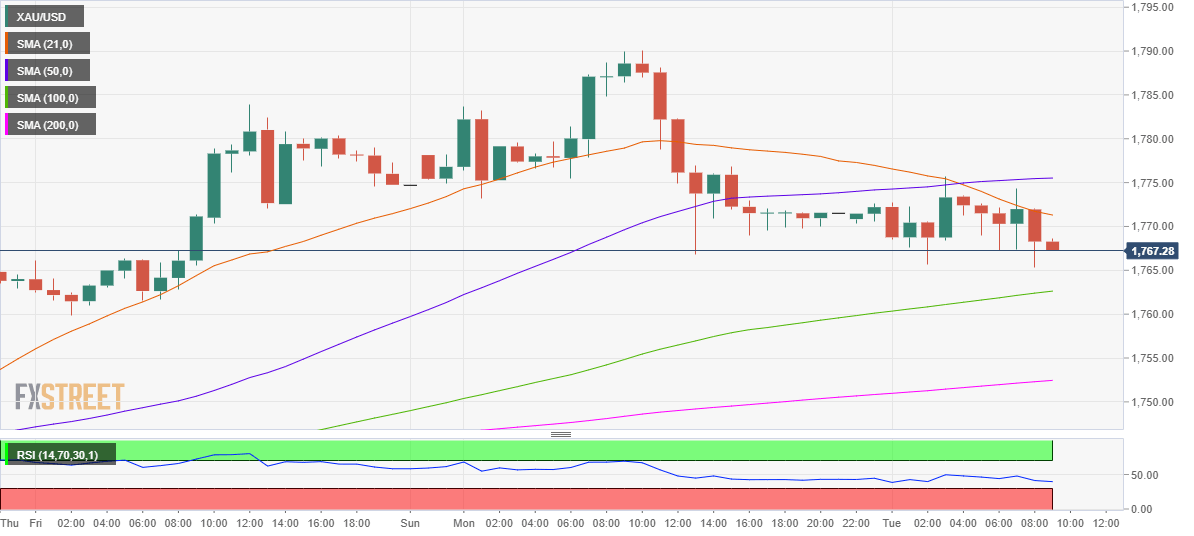

Gold Price Chart: Hourly

On the one-hour chart, gold’s upside attempts appear capped below the 21-hourly moving average (HMA) at $1772, as of writing.

An hourly closing above that level is needed to challenge the horizontal 50-HMA at $1775. Recapturing that hurdle is critical to reviving the upbeat sentiment around the yellow metal.

Further up, the previous week high at $1784 could be put to test, beyond which the three-week highs of $1790.

However, the Relative Strength Index (RSI) lurks in the bearish region, pointing to more losses in the offing.

The immediate downside target for the XAU/USD pair is seen at the mildly bullish 100-HMA at $1762.

The 200-HMA at $1752 could likely be the last resort for gold bulls.

Gold: Additional levels