- Gold attempts a bounce, as the US dollar pulls back from multi-month tops.

- XAU/USD wavers between 21 and 100-SMAs on the 4H chart.

- All eyes on the US data for a range breakout in gold.

Gold (XAU/USD) is looking to regain $1730, as the US dollar bulls take a breather after the recent advance to multi-month peaks.

The greenback remains buoyed by the US economic optimism and higher Treasury yields. Stronger US Jobless Claims further fuelled expectations of a faster economic recovery. Meanwhile, speeding vaccines rollout in America also backs the recent gains in the buck.

Gold markets now await a fresh batch of US economic releases, including the Fed’s preferred inflation gauge – the Core PCE Index, for fresh trading impetus.

From a short-term technical perspective, gold has entered a downside consolidative mode after Thursday’s reversal from $1746 levels.

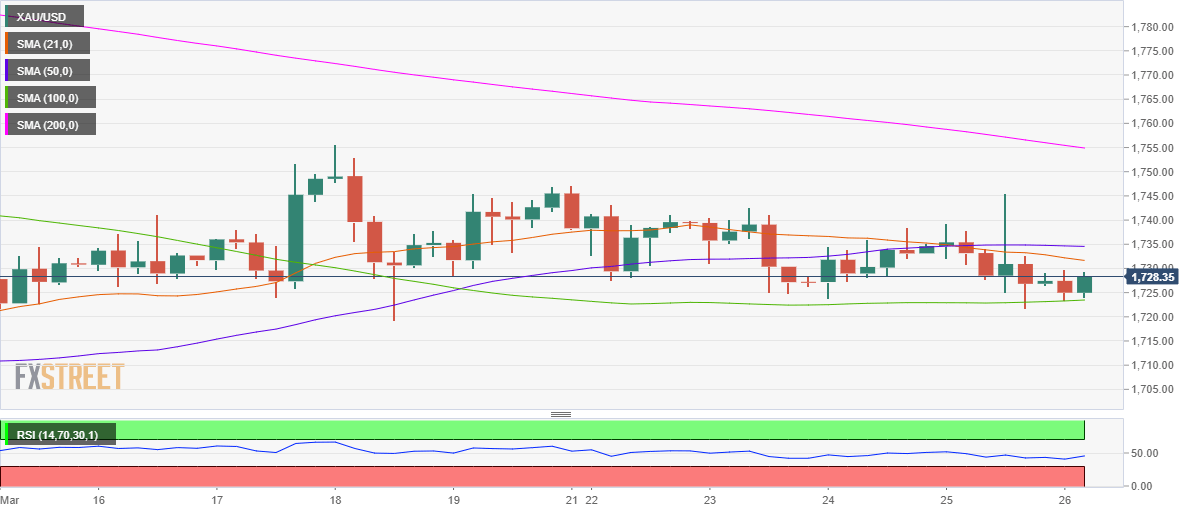

Gold Price Chart: Four-hour

Gold remains locked in a tight range on the four-hour chart, looking for a fresh direction likely on the US data release.

The bearish 21-simple moving average (SMA) at $1732 caps the rebound from weekly lows of $1721.80.

Meanwhile, the downside appears cushioned by the horizontal 100-SMA at $1723.

The Relative Strength Index (RSI) has ticked higher to 45.59, still remains below the midline, suggesting that the bearish bias still remains intact for gold.

The previous month low of $1717 could offer some strong support, below which the $1700 mark could be put at risk.

Alternatively, a sustained move above the 21-SMA barrier could expose the 50-SMA hurdle at $1735. The XAU bulls would then gear up for a rally towards the descending 200-SMA resistance at $1755.

Gold: Additional levels