Time is running out for Congress to agree on a near $1 trillion stimulus package before Christmas – and gold prices are retreating. Holders of the precious metal seem impatient to hear once again about progress in Washington and as white smoke is yet to appear.

The US begins vaccinating its population against COVID-19 – good news for markets but bad for XAU/USD bulls. How is gold positioned on the technical charts?

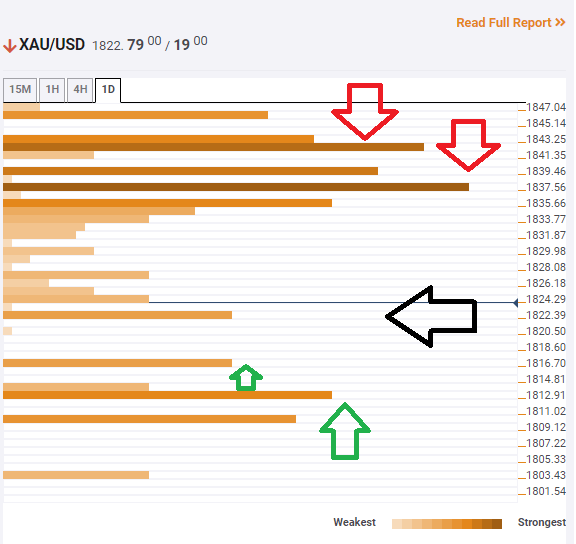

The Technical Confluences Indicator is showing that the precious metal is battling the $1,823 level, which is the convergence of the previous weekly low and the Bollinger Band 15min-Lower.

Looking up, XAU/USD faces resistance at the $1,836 area, which is a cluster of lines consisting of the BB 1h-Middle, the Simple Moving Average 10-4h, the SMA 10-one-day, the Fibonacci 38.2% one-day, and more.

An even stronger cap awaits at $1,842, which is the confluence of the SMA 200-1h, the Fibonacci 23.6% one-day, and the Fibonacci 61.8% one-week.

Some support awaits at $1,816, which is where the Pivot Point one-week Support 1 hits the price.

The next cushion is at $1,812, which is where the Fibonacci 23.6% one-month and the PP one-day S2 converge.

XAU/USD resistances and supports

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence