- Gold saw a massive $45 drop on Friday, hits six-week lows.

- The spot charted a potential bear pennant on hourly sticks

- XAU/USD dropped below major hourly Simple Moving Averages (HMA).

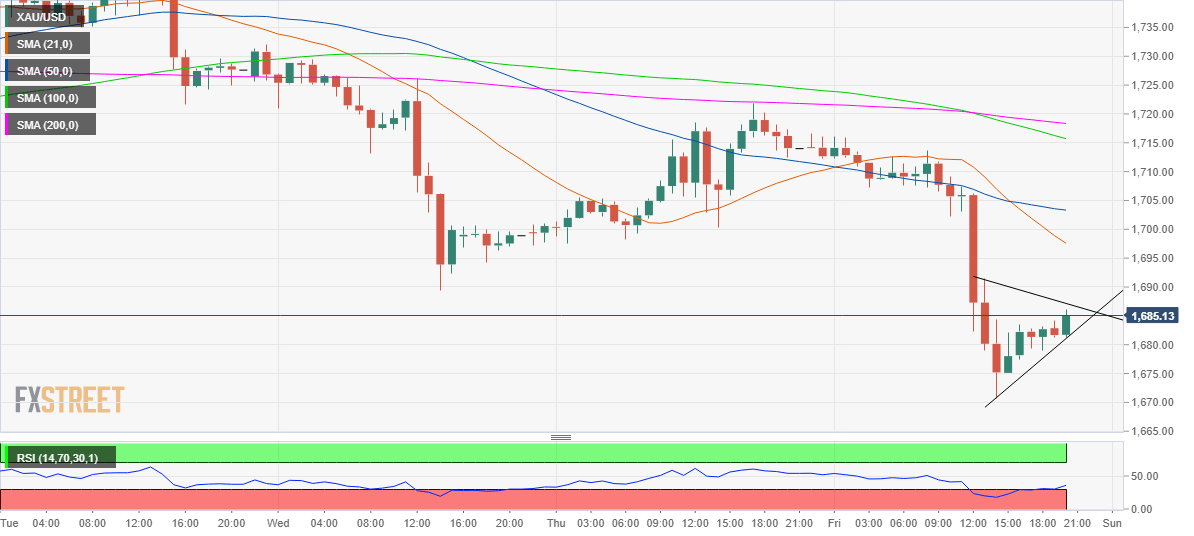

The massive $45 slump Gold prices (XAU/USD) on Friday created a bearish pennant formation on the hourly chart, indicating that the spot remains exposed to further downside risks in the near-term.

A decisive break below the rising trendline support around 1680 would validate the pattern, with a test of $1656 due on the cards. In absence of any healthy support levels keep the bears hopeful. Further, the prices have breached all the major HMAs on its south run, adding to the bearish bias.

The hourly Relative Strength Index (RSI) has bounced-off the oversold territory and therefore, a minor bounce cannot be ruled out the downside resumes.

Friday’s decline picked up pace after the 100-HMA pierced the critical 200-HMA from above.

Note that a bear pennant is usually a bearish continuation pattern.

Gold: Hourly chart

Gold: Additional levels