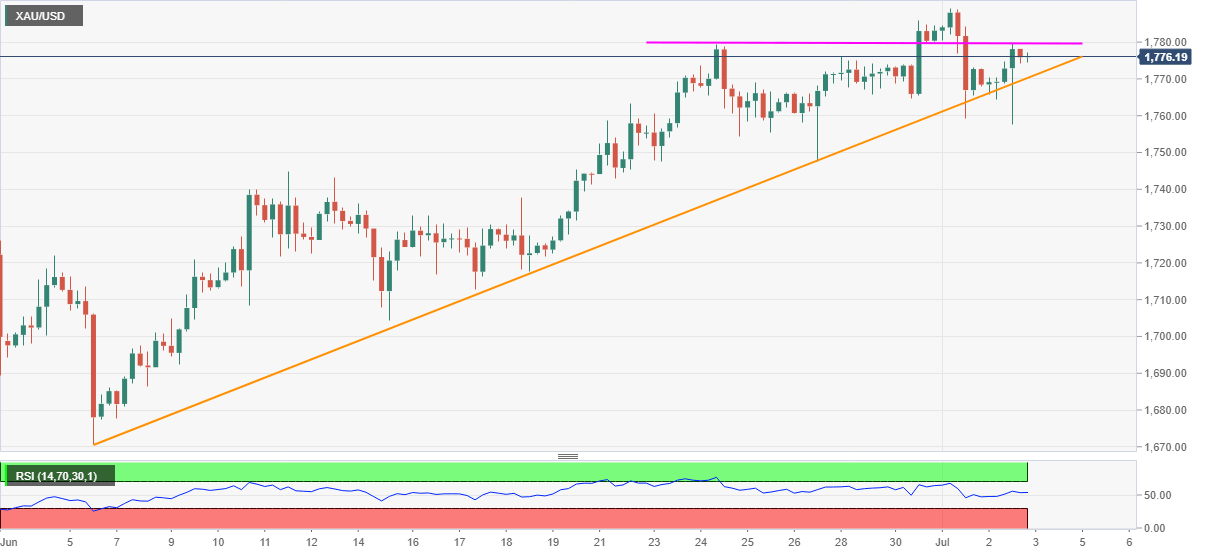

- Gold prices stay pressured within a choppy range between $1,774 and $1,778.

- The monthly support line keeps buyers hopeful unless the quote breaks the monthly support line.

- The early-June tops could lure the bears during fresh downside, buyers may aim to refresh the year 2012 top.

Gold prices remain lackluster below $1,780, currently around $1,776.44, during the early Friday’s Asian session. The bullion flashed a positive closing the previous day but couldn’t cross the one-week-old horizontal resistance. Though, the monthly support line continues to stop bears’ entry.

As a result, the buyers will look for a clear break above $1,780 to challenge the recent tops surrounding $1,789/90. However, the year 2012 top near $1,795/96 and $1,800 threshold can offer additional upside barriers afterward.

In a case where the precious metal stays strong beyond $1,800, it’s rise towards November 2011 and August 2011 peaks, respectively around $1,803 and $1,815, can’t be ruled out.

Meanwhile, a downside break of the monthly support line, currently near $1,770, could drag the quote towards June 11 high close to $1,745.

Should the bears remain dominant past-$1,745, they will keenly seek a break below $1,700 mark to recall the June month low near $1,670.

Gold four-hourly chart

Trend: Pullback expected