- Gold fades bounce off 12-day low, eases from intraday high off-late.

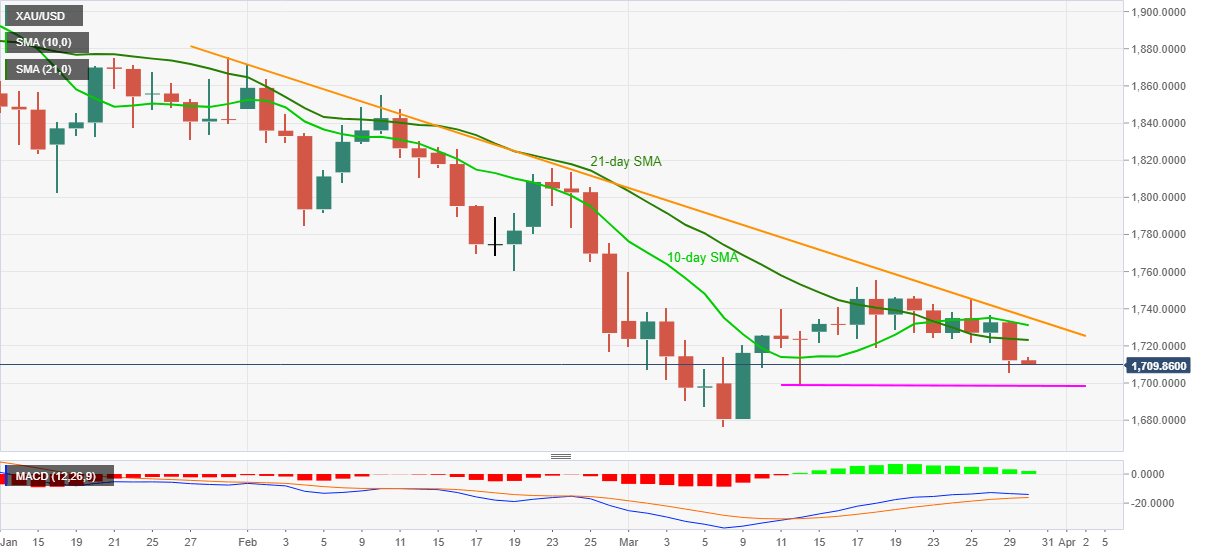

- Receding bullish signals from MACD, downside break of 21-day SMA direct sellers toward March 12 low.

- 10-day SMA, two-month-old falling trend line add to the upside filters.

Following its failures to rise past-$1,714.46, gold prices drop to $1,710, down 0.11% intraday, during early Tuesday. In doing so, the yellow metal justifies the previous day’s daily closing below 21-day amid weakening bullish MACD signals.

Also favoring the gold sellers could be the commodity’s sustained trading below 10-day SMA and a descending resistance line from January 29.

As a result, the bears are all set to challenge March 12 lows near the $1,700 threshold before attacking the monthly bottom surrounding $1,675.

It should, however, be noted that a downward sloping trend line from August 2020, near $1,656, could restrict the quote’s further south-run.

Alternatively, an upside clearance of 21-day SMA level of $1,723 isn’t a call to the gold buyers as 10-day SMA and aforementioned resistance line, respectively near $1,731 and $1,735, keep traders worried.

Even if the precious metal crosses $1,735 on a daily closing basis, November 2020 lows near $1,765 become the key resistance to watch for the gold buyers.

Gold daily chart

Trend: Further weakness expected