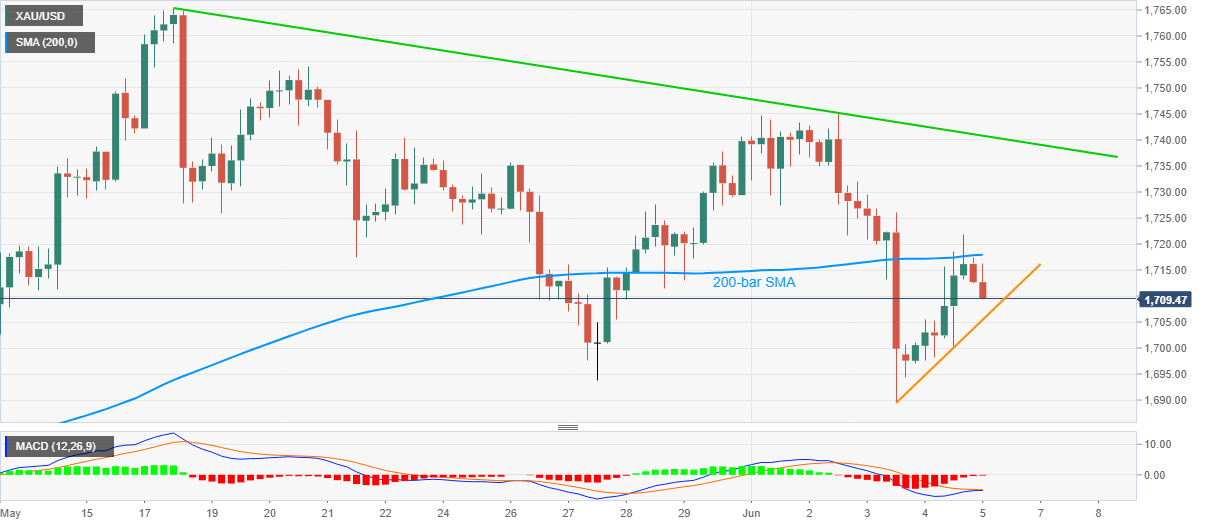

- Gold prices remain weak after taking a U-turn from $1,721.88.

- A two-day-old support line holds the key to further downside.

- A 14-day-long falling trend line adds to the upside barrier.

Gold prices decline to $1,709.34, down 0.27% on a day, during the pre-European session on Friday.

In doing so, the yellow metal extends its pullback moves from 200-bar SMA, which in turn portrays the bullion’s weakness.

However, an ascending trend line from Wednesday, currently near $1,705, restricts the precious metal’s additional declines.

In a case where the bears dominate past-$1,705, the monthly low near $1,689.50/45 and the May month’s low near $1,671/70 could return to the charts.

Meanwhile, an upside clearance of 200-bar SMA, at $1,718 now, isn’t going to trigger the commodity’s rally as a downward sloping trend line from May 18, near $1,741, might question the buyers past-$1,718.

Gold four-hour chart

Trend: Further downside likely