- The price of gold is under pressure as the US dollar picks up a safe haven bid and US yields take to the moon.

- Archegos Capital’s default keeps markets on edge.

The price of gold is falling at the start of the week as the US dollar extends higher despite the shallow daily correction on the DXY.

At the time of writing, the DXY is trading higher by 0.21% while XAU/USD is down by over 1.32% on the day so far.

The 10-year yield is higher by 2.56% having made a recent high of 1.7170%.

Meanwhile, markets are on edge as investors brace for the Nonfarm Payrolls event at the end of the week, as well as quarter-end and all the while the financial sector is on the lookout for contagion and any potential negative ramifications from the hedge fund defaults in the banking sector.

Wall Street’s main benchmarks started the week on the back foot as news spread that global banks, such as Credit Suisse, said they faced potential large losses after the New York City-based Archegos Capital defaulted on its margin call.

Possible ramifications for gold on Archegos

The Archegos impact remains limited for now.

The effect has so far been concentrated on a few companies.

However, given the global banking matrix and how deeply interconnected it is, the sector is exposed to the risk of contagion and that may not bode well for gold in the near term.

In 2020, when the banking sector was hit hard as the world responded to the covid pandemic and the US dollar funding markets came under stress, precious metals fell hard on the knee jerk as the markets scrambled for US dollars.

Silver dropped by as much as 38% between the 24th Feb and 16th March while gold was favoured of the two, but still shed over 14.8%.

So far, however, this has been reported as a one-off unfortunate event and a risk to only a few named banks.

At first sight, Archegos, which managed only its founder’s and trader’s money, does not look to be another Long Term Capital Management, a darling of Wall Street that collapsed in the late 1990s (a trading book so big and complicated that it required a bailout).

Nonfarm Payrolls risks

So far, the US dollar is firm on prospects of higher rates and this week’s Nonfarm Payrolls will be closely monitored for more inflationary risks.

The market median in the Bloomberg survey stands at a buoyant 650K. The highest number in the survey is 110K and the lowest 350K. Even the bottom forecast is above the average of the past 6 months.

The US dollar would be expected to benefit from an inline number which would be an additional weight for gold.

The shift up in US bond yields today is a testament to the market’s focus on the potential for higher rates of growth and inflation.

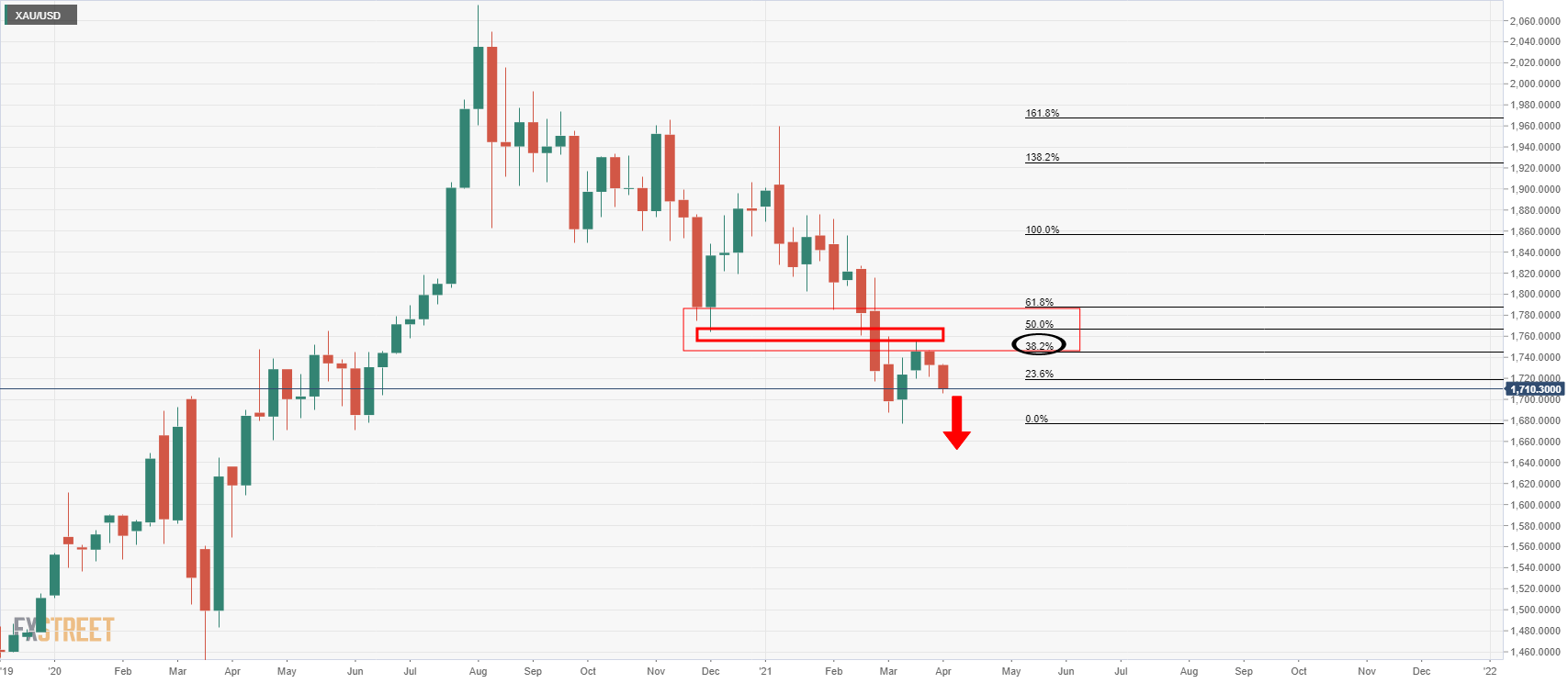

Gold technical analysis

The weekly outlook is bearish in that the market has corrected the bearish impulse in a significant Fibonacci retracement which would now be expected to see a continuation to the downside.