- XAU/USD rebounds after closing in the negative territory on Monday.

- 10-year US Treasury bond yield is edging lower on Tuesday.

- Additional gains are likely if gold manages to clear $1,775 resistance.

Despite the heavy selling pressure surrounding the greenback, the XAU/USD pair posted losses on Monday as the recovering US Treasury bond yields made it difficult for gold to find demand. With the benchmark 10-year US T-bond yield losing nearly 1% on Tuesday, however, the pair managed to regain its traction and was last seen gaining 0.2% on the day at $1,774.70.

Gold technical outlook

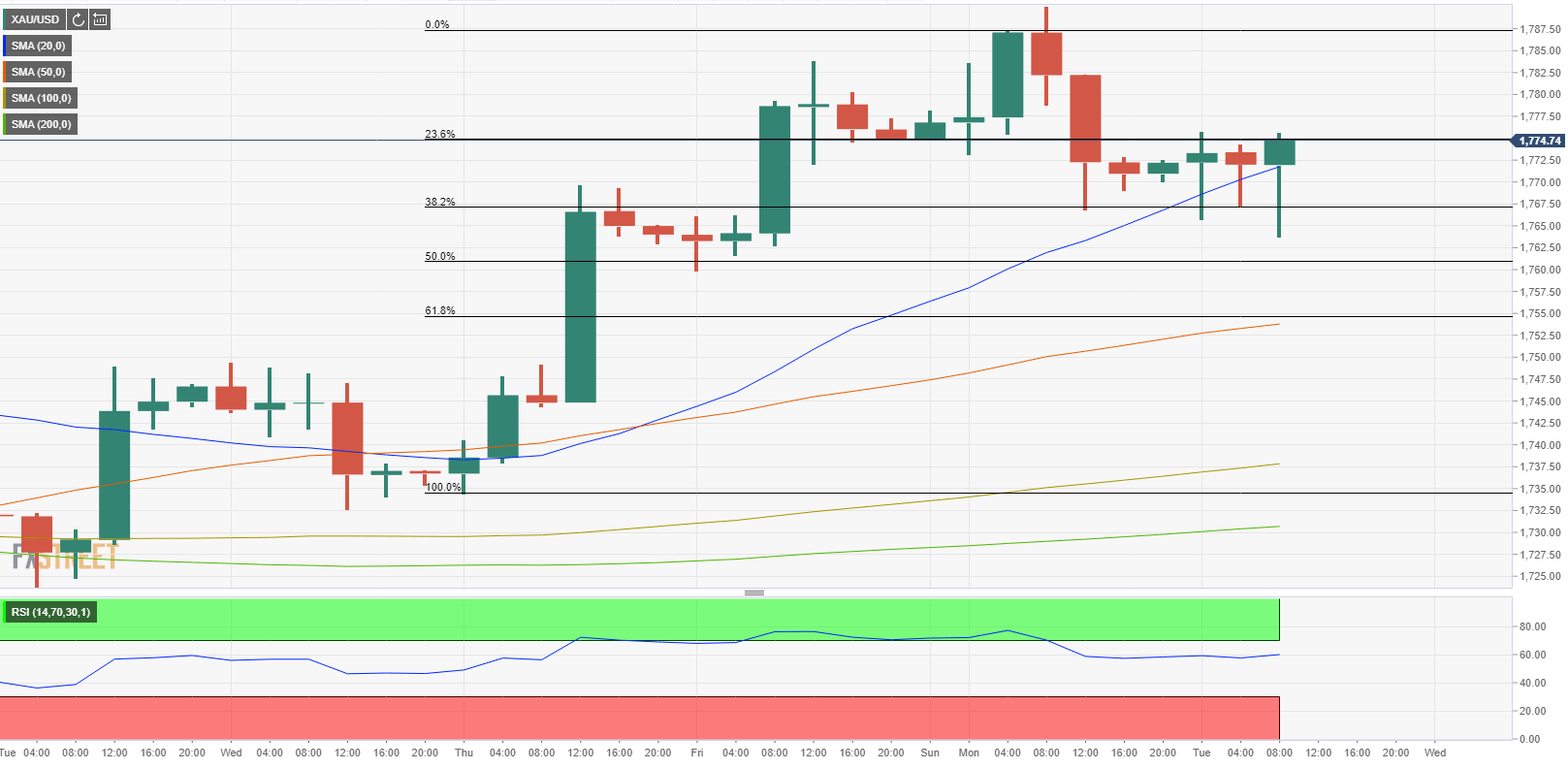

Gold is currently trading around the Fibonacci 23.6% retracement of the latest uptrend that started on Thursday and lasted for three trading days. If XAU/USD manages to close a four-hour candle above that level, it could look to test $1,790 (Monday high) ahead of $1,800 (psychological level).

However, the sharp U-turn witnessed at $1,790 on Monday suggests that gold could struggle to clear that hurdle unless the move is fueled by another leg down in US T-bond yields.

On the downside, the initial support is located at $1,772 (20-period SMA) before $1,767 (Fibonacci 38.2% retracement) and $1,760 (Fibonacci 50% retracement).