Gold has been moving up and down in response to the latest headlines from Capitol Hill regarding fiscal stimulus. Will Mitch McConnell accept a near $1 trillion relief package? Countering the economic effects of coronavirus would boost not only the economy but also the precious metal.

At the time of writing, talks continue and there is hope that some progress could be made. XAU/USD has recovered from the lows and seems well-positioned to continue higher.

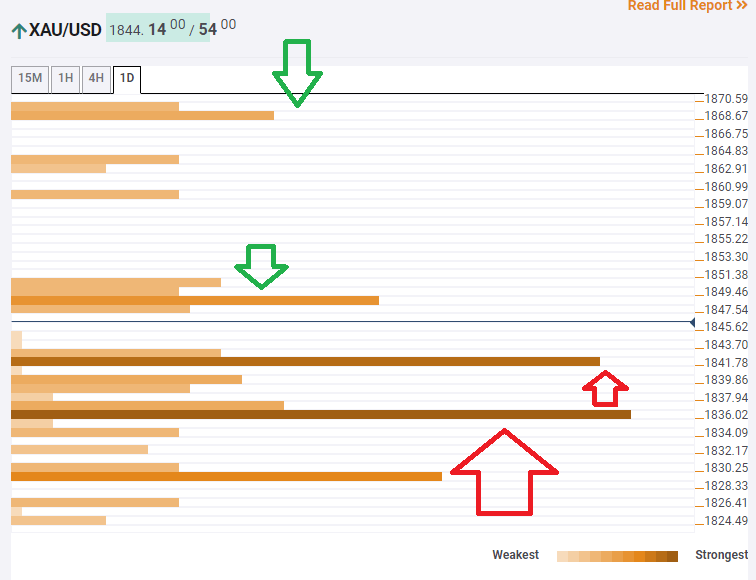

The Technical Confluences Indicator is showing that gold has significant support at around $1,841, which is the convergence of the Bollinger Band one-day Middle, the BB 1h-Upper, and the Fibonacci 38.2% one-month.

Another cushion awaits at $1,836, which is the meeting points of several Simple Moving Averages, the SMA 5-4h, the SAM 10-1h, the SMA 10-4h, and the SMA 50-15m.

Resistance awaits at $1,847, which is the confluence of the Pivot Point one-day Resistance 1 and the previous weekly high.

Gold’s upside target is at $1,868, which is the meeting point of two pivot points – the one-day R3 and the one-week R3.

XAU/USD resistances and supports

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence