- Gold consolidates on recent recovery rally from $1,764 to $1,875.

- The four-month falling trendline hurdle is still intact.

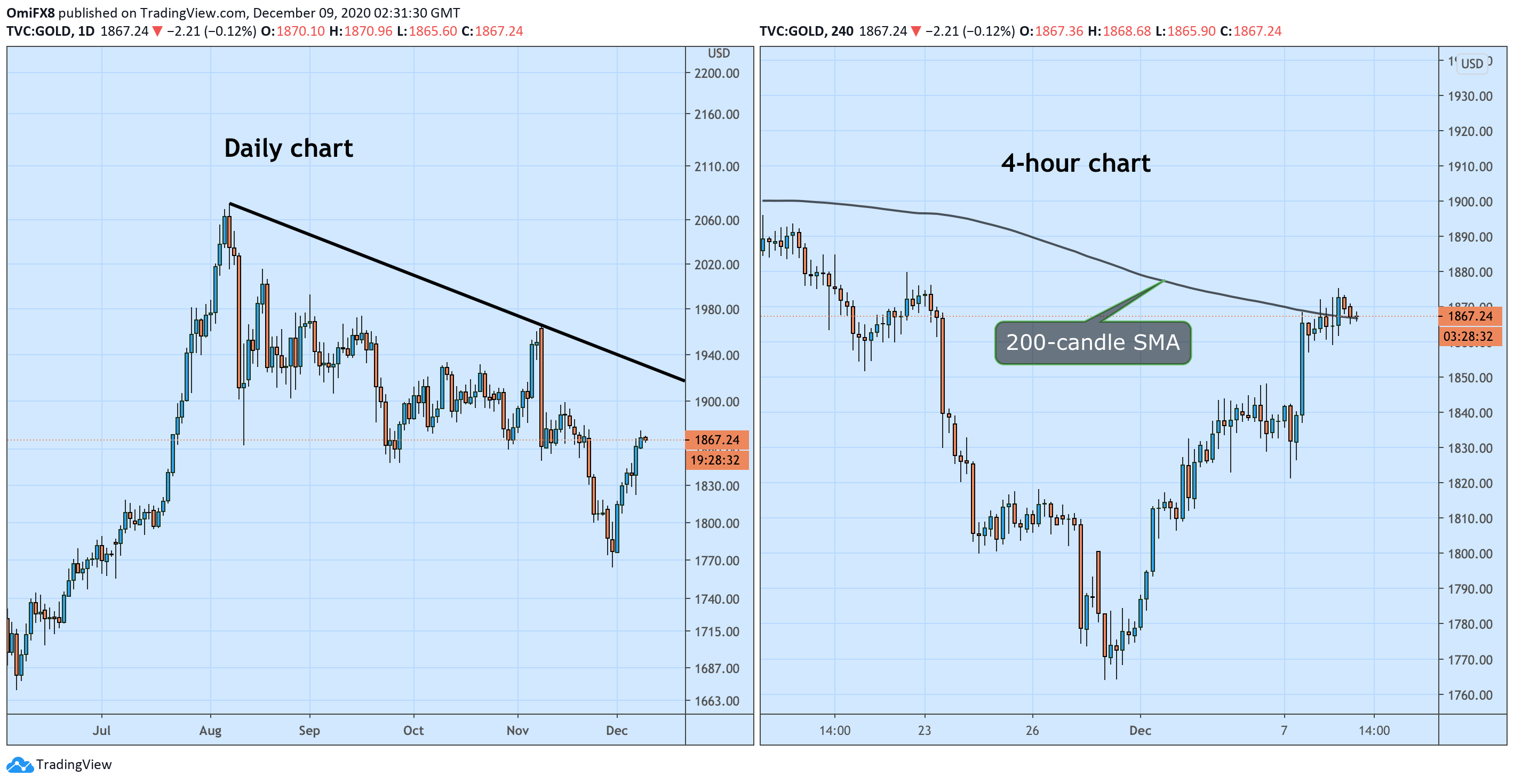

Gold trades near the 4-hour chart 200-candle Simple Moving Average (SMA) of $1,866, having risen from $1,764 to $1,875 in the previous seven trading days.

The recovery looks to have been fueled by an uptick in the US inflation expectations, as discussed Tuesday. However, the metal is still down over 10% from the record high of $2,075 registered in August.

Some analysts say the broader bull market from lows near $1,450 observed in March is intact, and the metal has seen at least six pullbacks of 10% in the previous bull cycle.

That prospects of a re-test of that level would rise once the resistance of the trendline falling from Aug. 7 and Nov. 9 highs is scaled. The trendline hurdle is currently located near $1,930.

A failure to hold above support at $1,850 would shift riks in favor of a decline to recent lows below $1,800.

Daily and 4-hour charts

Trend: Bullish

Technical levels