- Gold’s recovery from four-month lows falters.

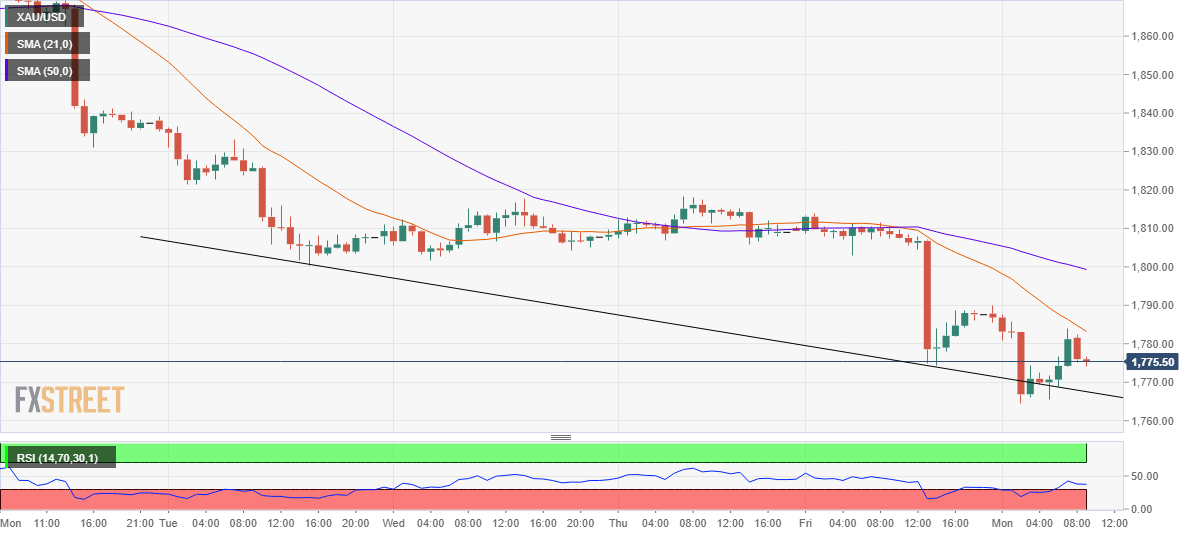

- Sellers lurk at 21-HMA of $1784, with eye still on $1750.

- Hourly RSI turns south below the midline.

Gold’s recovery from four-month lows of $1765 lost legs at the bearish 21-hourly moving average (HMA) at $1784 in the European session.

The fresh leg down in the yellow metal came after the European equities turned positive after opening in the red, as the risk rally driven by the coronavirus vaccine-driven optimism resumes.

The hourly chart of gold shows that the price is headed back to test the one-week-long descending trendline support, now at $1768.

A break below which the multi-month lows could be retested. Further south, the July 2 low of $1758 will offer strong support. The $1750 psychological level will be the level to beat for the bears.

The hourly Relative Strength Index (RSI) has turned south while within the bearish zone, having stalled its recovery, suggesting that the downside could likely resume.

Alternatively, acceptance above the critical 21-HMA could expose the daily high at $1790. The next relevant upside target awaits at the 50-HMA of $1800.

Gold Price Chart: Hourly

Gold: Additional levels