Following Tuesday’s two-way wild swings, Gold (XAU/USD) returns to the backseat, as the haven demand for the US dollar remains in vogue amid the risk-off action in the global stocks. The sentiment soured on rising US-Sino tensions, US fiscal deadlock and pessimism over the coronavirus vaccine. AstraZeneca COVID-19 vaccine trial was put on hold over safety concerns.

Although the dovish ECB expectations and falling Treasury yields offer some support to the yieldless gold. Combined. Let’s take a look at the key technical levels for trading gold amid a light US docket and heading towards Thursday’s crucial ECB policy decision.

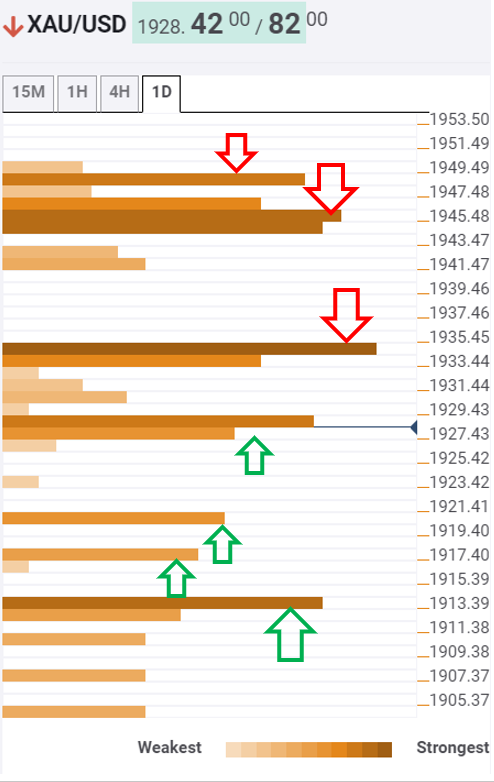

Gold: Key resistances and supports

The tool shows that gold is battling a significant upside hurdle at $1928.50, the confluence of Fibonacci 38.2% one-day and SMA10 four-hour, following a brief dip to $1923 region.

Acceptance above the latter could add extra legs to the bounce, as the bulls look to test the next critical hurdle at $1934.45, where the Fibonacci 23.6% one-week, SMA5 one-day and Fibonacci 23.6% one-day intersect.

Further north, powerful resistance awaits at $1945/46, which is the convergence of the SMA10 one-day, Fibonacci 38.2% one-month and one-week.

A firm break above the latter could yield a test of $1949 barrier, the SMA50 on four-hour.

To the downside, minor supports at $1920 (Fibonacci 61.8% one-day) and $1917 (previous week low) could slow the declines.

Meanwhile, a $1913 cushion is the level to beat for the bears. That level is the Fibonacci 23.6% one-month.

A daily closing below the last is needed to reinforce the bearish bias.

Here is how it looks on the tool

About the Confluence Detector

With the TCI (Technical Confluences Indicator) tool, you can easily locate areas where the price can find a support zone or resistance zone and make trading decisions. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points each time. If you are a medium- and long-term trader, this tool will allow you to know in advance the price levels in which a medium / long-term trend can stop your travel and rest, where to undo positions or where to increase your position.

Learn more about Technical Confluence