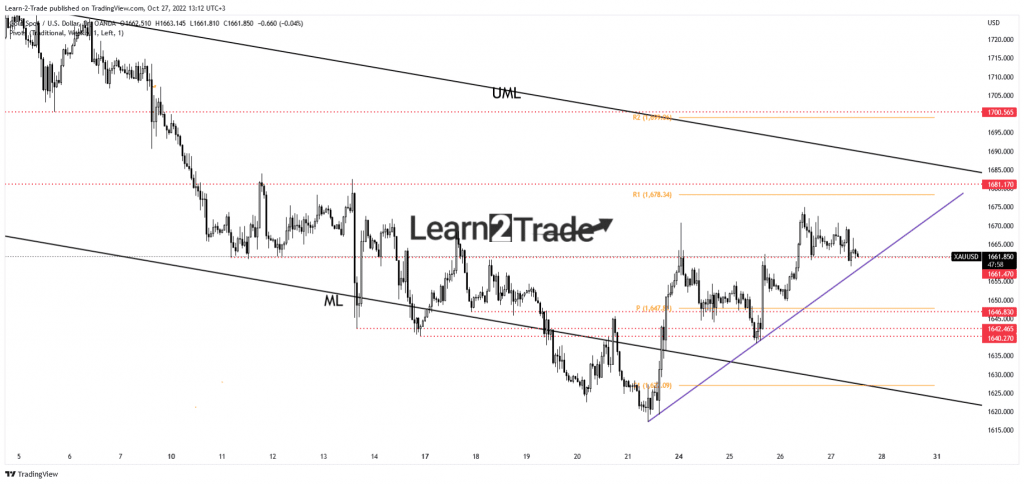

- XAU/USD maintains a bullish bias as long as it stays above the uptrend line.

- The ECB and the US Advance GDP could really shake the markets.

- Dropping and closing below the uptrend line activates more declines.

The gold price slipped lower after reaching $1,675 yesterday. The precious metal is trading at 1,662 at the time of writing.

–Are you interested to learn more about ECN brokers? Check our detailed guide-

Gold has changed short term as traders wait for the ECB before taking action. The European Central Bank is expected to increase the Main Refinancing Rate from 1.25% to 2.00%. The Monetary Policy Statement and the ECB Press Conference could significantly impact and bring sharp movements in gold. The XAU/USD could drop deeper if the ECB announces further rate hikes in the next monetary policy meetings.

Furthermore, the US is to release high-impact data as well. The Advance GDP may report a 2.3% growth compared to the 0.6% drop in the previous reporting period. The fundamentals will drive the markets today. That’s why you’ll have to be careful. Gold could register sharp movements around the ECB and after the US data dump.

In addition, the Advance GDP Price Index could report a 5.3% growth, and Core Durable Goods Orders are expected to register a 0.2% growth. At the same time, the Unemployment Claims indicator could jump from 214K to 219K in the previous week. Tomorrow, the BOJ is seen as a high-impact event and could shake the markets.

Gold price technical analysis: Temporary retreat?

Technically, the bias remains bullish in the short term as long as it stays above the minor trendline. The $1,661 represents a downside obstacle as well. It remains to see how XAU/USD reacts around the confluence area formed at the intersection between these downside obstacles. Testing the support levels and registering only false breakdowns may signal a new upside momentum.

–Are you interested to learn more about making money in forex? Check our detailed guide-

On the other hand, a valid breakdown may activate a further drop toward the weekly pivot point of 1,647. From the technical point of view, the current drop could represent a flag pattern which could result in more gains. Still, it’s premature to talk about an upside continuation as the ECB, and the US data could change the sentiment.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.