- Risk on impulse permits US Treasury bond yields to recover the major sharp intraday fall and exert some extra pressure on the non-yielding yellow metal.

- Investors seem reluctant to place aggressive bets. Instead preferred to wait on the sidelines for this week’s risk.

- Sustained weakness might prompt some aggressive technical selling and accelerate the side further towards the Dollar supporting the area.

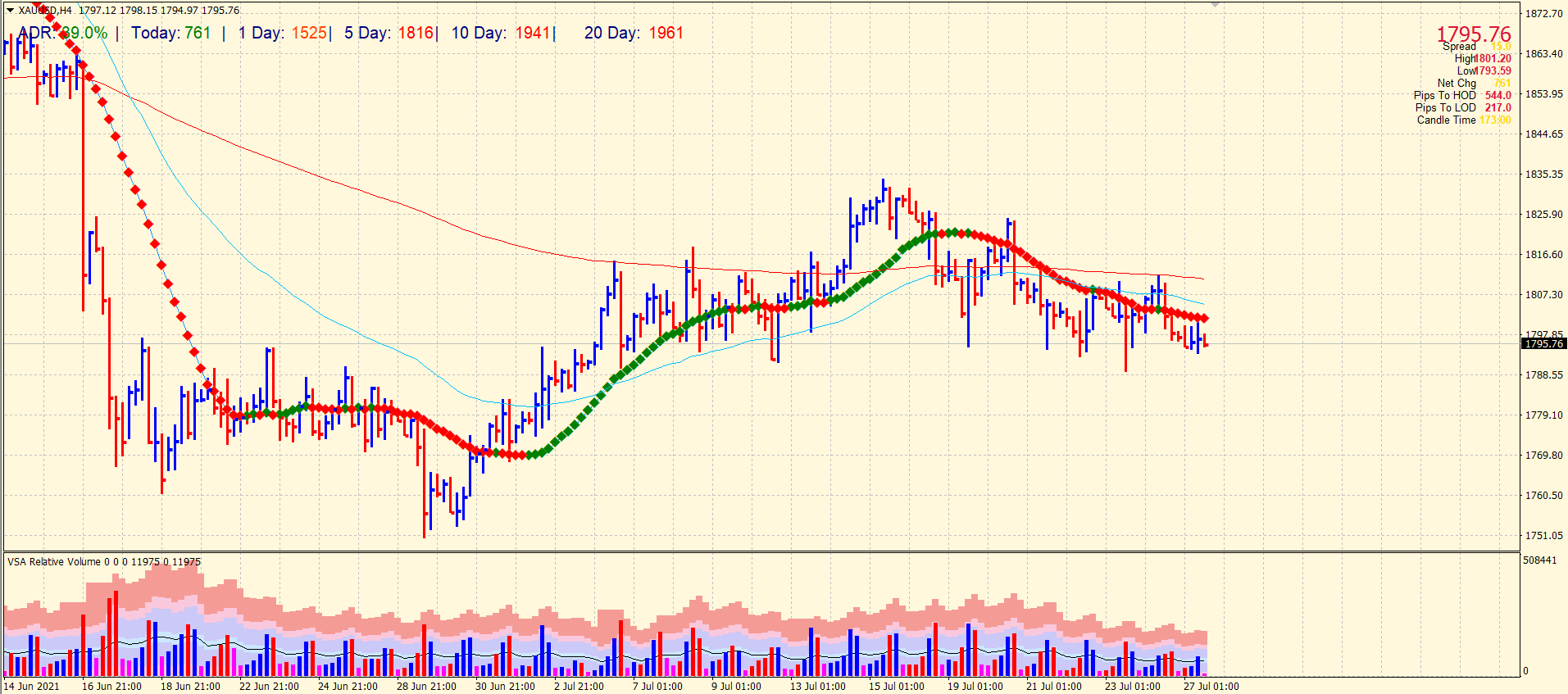

Gold analysis competes to capitalize on modest intraday gains while meeting several fresh supplies near the $1,811-12 region, and it ended in red for a second straight session on Monday amid a lack of major market-moving economic releases.

–Are you interested to learn more about automated trading? Check our detailed guide-

In US equity, a good rebound became a critical factor that undermined the safe-haven precious metal. Moreover, risk on impulse permitted US Treasury bond yields to recover the significant intraday sharp fall and exerted some extra pressure on the non-yielding yellow metal.

Bulls seemed unaffected by the broad-based US Dollar weakness, which benefits the Dollar dominating commodities, including gold. Nonetheless, the XAU/USD settled near the lower end for its daily trade range. However, it lacked any follow-through selling. Worries about economic fall from the fast-spreading 4th layer of covid known as delta variant.

In the broader sense, XAU/USD has been oscillating in the average trading range over the last week. Investors seem reluctant to place aggressive bets. Instead preferred to wait on the sidelines for this week’s risk.

The FOMC meeting is to start this Tuesday. Policymakers are expecting to discuss the plans about the slowing pace of monthly bond purchases. Fed scheduled to announce the decision on Wednesday to influence the Dollar in the near term and provide fresh directional impetus to the commodity.

Meanwhile, on Tuesday, traders will take cues from the US economic docket and highlight the releases of durable goods orders and Conference Board Consumer Confidence Index. Along with this development surrounding the Covid-19, the broader market risk sentiment, US bond yields, and USD price dynamic might produce some trading opportunities around XAU/USD.

Gold technical analysis: Bears still shy to go deeper

The $1,790 level might continue to defend the immediate downside from the technical view and act as the pivotal point for short-term traders. However, sustained weakness might prompt some aggressive technical selling and accelerate the side further towards the support area. Followed by monthly swing lows around the $1750 area, which, if broken decisively, will move the near-term bias back in favor of bearish traders.

–Are you interested to learn more about forex signals? Check our detailed guide-

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.