- The bias remains bearish in the short term, despite temporary rebounds.

- A new lower low activates more declines.

- The US manufacturing and services data should bring sharp movements.

The gold price dropped again after ending its temporary rebound. The metal is trading at $1,963, far below Friday’s high of $1,984.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

The bias remains bearish in the short term as the USD bulges. DXY’s further growth should force the yellow metal to drop.

Today, the Eurozone, UK, and United States manufacturing and services data could move the prices. The German Flash Services PMI jumped from 56.0 points to 57.8 points, even though the traders expected a potential drop to 55.0 points, while German Flash Manufacturing PMI dropped to 42.9 points from 44.5, confirming further contraction.

Furthermore, in the Eurozone, Flash Services PMI came in better than expected, while Flash Manufacturing PMI reported worse than expected data. Later, the UK Flash Services PMI and Flash Manufacturing PMI could bring more action.

Still, only the US data could shake the markets. The Flash Manufacturing PMI is expected at 52.6 points versus 53.6 points in the previous reporting period, while Flash Manufacturing PMI could be reported at 50.0 points.

Furthermore, the New Home Sales and Richmond Manufacturing PMI indicators will also be released. Positive US data should bring more sellers on the XAU/USD.

Gold price technical analysis: Bearish bias

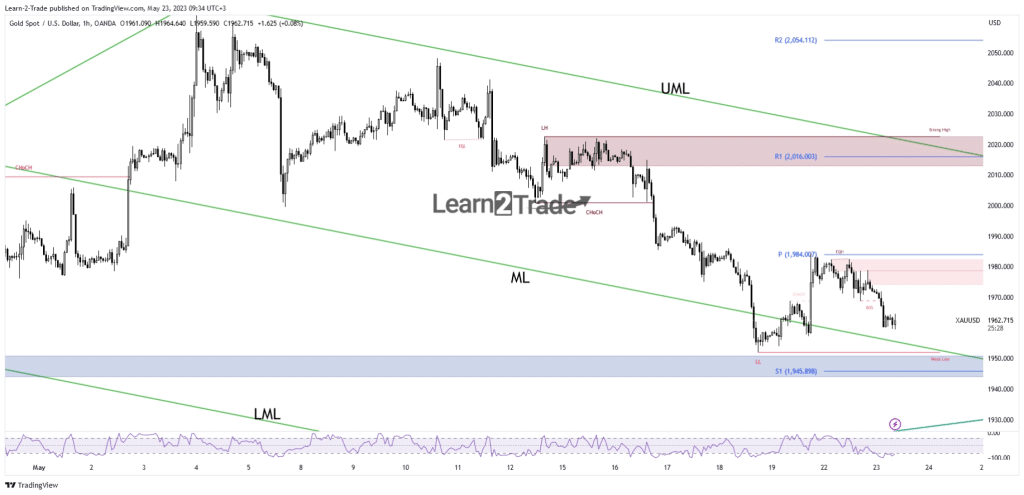

Technically, the XAU/USD found strong resistance below the weekly pivot point of $1,984. Now, it has reached the median line (ML) of the descending pitchfork, representing dynamic support.

–Are you interested to learn more about forex trading apps? Check our detailed guide-

The metal stands above a major demand zone, so it remains to see how it reacts. False breakdowns below the median line (ML) and a bullish reversal pattern should trigger a new potential rally.

Still, a valid breakdown and a new lower low activates more declines. The downside pressure remains high despite temporary rebounds.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.