Gold price is trading at 1,815.09 at the moment of writing. It seems ready to come back higher after registering only a false breakdown with great separation below the immediate downside obstacles.

–Are you interested to learn more about scalping brokers? Check our detailed guide-

DXY’s sell-off from 93.03 today’s high helped the price of gold to recover. Still, we need confirmation before going long again on gold. Now is pressuring strong upside obstacles. However, a valid breakout could signal more gains ahead.

XAU/USD could resume its growth if the Dollar Index slips lower within the Rising Wedge pattern. Also, some poor US data reported during the week could attract more buyers of gold. The ECB and the manufacturing and services figures could shake the markets at the end of the week. These events could have a big impact on XAU/USD.

Gold price technical analysis

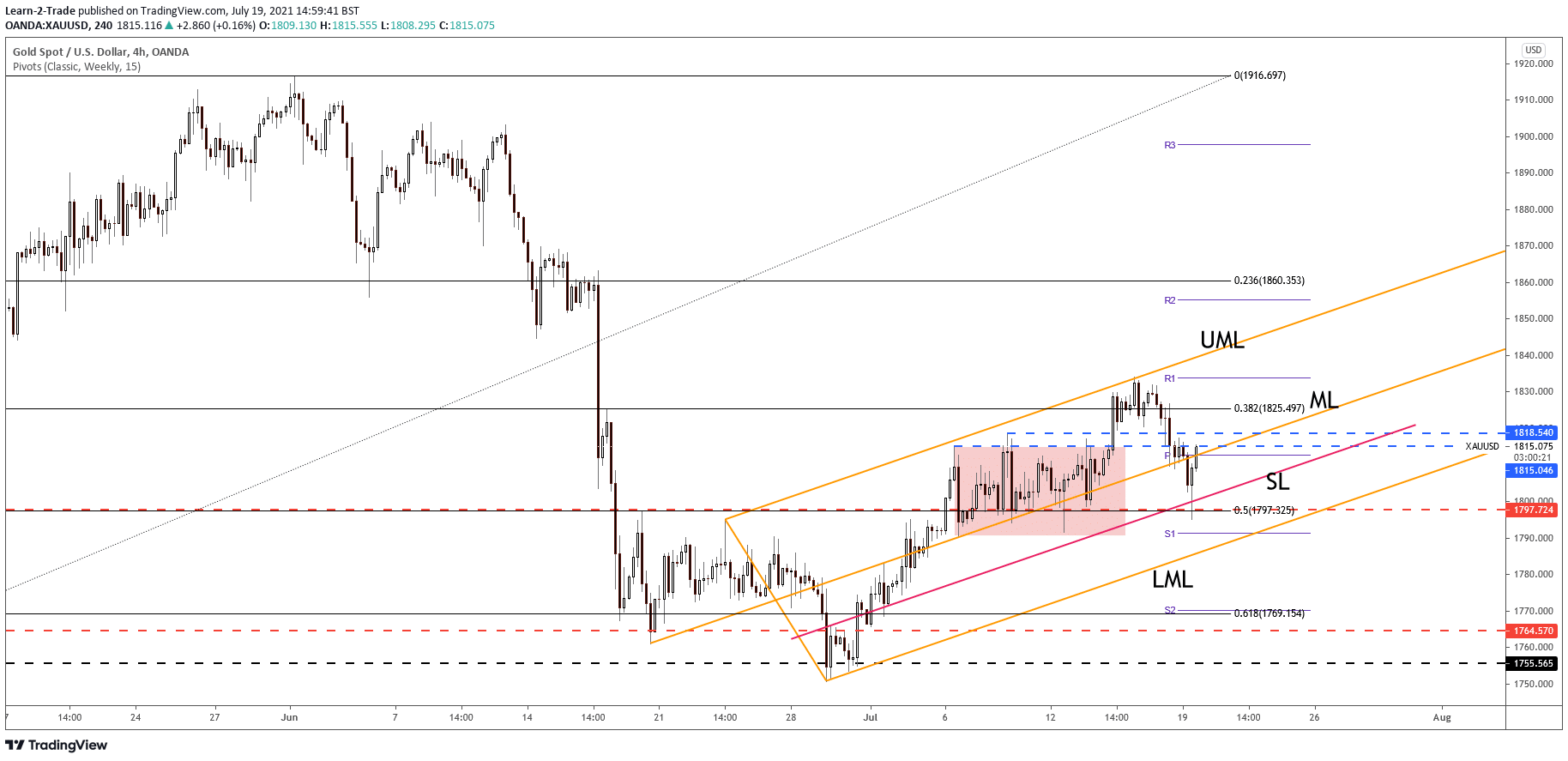

Gold has registered only a false breakdown with great separation through the down inside sliding line (SL) and below the 50% retracement level. Thus, 1,797.72 represents static support as well. Now is challenging the confluence area formed at the intersection of the weekly pivot point (1,812.68) with the ascending pitchfork’s median line (ML).

–Are you interested to learn about forex robots? Check our detailed guide-

Coming back above the median line (ML) could signal that the downside movement is over and that the bulls could take full control again. On the other hand, staying under the median line could signal that the pressure is still high and that XAU/USD could come back down towards the immediate downside obstacles.

A temporary decline was somehow expected after reaching the ascending pitchfork’s upper median line (UML). Personally, I believe that the bias could be bullish as long as it stays above the inside sliding line (SL), seen as a dynamic support.

Larger growth could be indicated and validated by potential-jump and stabilization above the 38.2% retracement level.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.