- Gold remains under strong upside pressure despite temporary drops.

- The US retail sales and Canadian CPI could be decisive tomorrow.

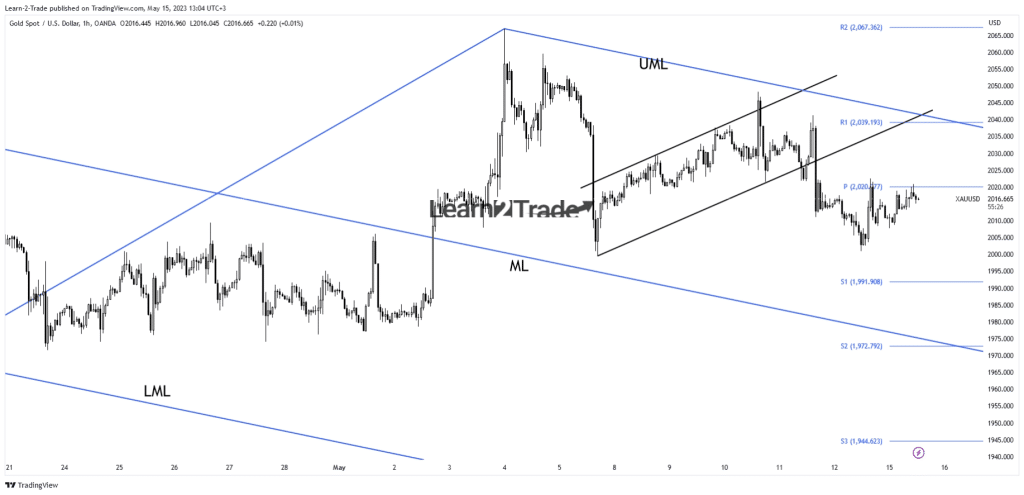

- A new higher high activates further growth towards the upper median line (UML).

The gold price climbed as high as $2,020 today. However, the metal has turned to the downside and is trading at $2,015 while writing.

–Are you interested in learning more about day trading brokers? Check our detailed guide-

In the short term, gold has attempted to recover as the US Prelim UoM Consumer Sentiment came in worse than expected on Friday.

The economic indicator was reported at 57.7 points versus 63.0 points expected, compared to the 63.5 points in the previous reporting period. Today, the Empire State Manufacturing Index is expected at -3.7 points versus 10.8 in April.

This is seen as a high-impact event that could shake the markets. Most likely, the price of gold could register sharp movements in the US session.

The fundamentals should drive the market tomorrow as the UK, Canada, and the US will release high-impact data again. The US Retail Sales indicator may report a 0.8% growth after the 1.0% drop in the previous reporting period, while Core Retail Sales are expected to register a 0.5% growth. Furthermore, Capacity Utilization Rate, Industrial Production, and Business Inventories will also be released.

The yellow metal remains bullish in the medium to the long term, but it could react negatively to the Canadian inflation data. The Consumer Price Index is expected to report a 0.5% growth.

Gold price technical analysis: Corrective upside

Technically, the gold price rebounded after finding support above the former swing low of $1,999. XAU/USD reached the $2,000 psychological level and then turned to the upside.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

Still, the rebound seems over as the price failed to make a new higher high or to take out the weekly pivot point of $2,020.

As you can see on the hourly chart, the price registered only false breakouts through this static obstacle. Only a new higher high activates further growth towards the upper median line (UML) again.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.