- Gold gains momentum for the third day, climbing to a new weekly high on Thursday.

- The less hawkish Fed supported the metal amid the recent COVID-19 outbreak in China.

- The prospect of further tightening by the Fed fueled demand for the US dollar and limited its growth.

The gold price rose for the third straight day on Thursday after recovering from the $1,850 area this week. While bulls struggled to capitalize on the move beyond the $1,900 level, spot prices reached a new weekly high at the start of the European session.

–Are you interested in learning more about spread betting brokers? Check our detailed guide-

The Fed raised the federal funds rate by 50 basis points on Wednesday, marking the biggest rate hike since 2000 and the start of quantitative tightening (QT). However, it downplayed the likelihood of further rate hikes.

In a press conference following the meeting, Powell allayed market concerns about more aggressive policy tightening by stating that the Fed was not considering a 75-basis point rate hike in June. The yellow metal was thus perceived as having some support from this factor. Further, concerns over the potential economic impact of rising COVID-19 cases and strict Chinese restrictions have helped safe-haven gold.

As evidenced by renewed growth in Treasury yields, markets are still expecting another hike of 200 basis points by the end of 2022. As a result, this helped revive demand for the US dollar and slowed the growth of dollar-denominated goods.

Therefore, it is prudent to wait for any strong follow-on buying before concluding gold has bottomed out near $1,850 and is poised for a stronger near-term uptrend.

During the early North American session, market participants will now be looking forward to releasing the US economic calendar with weekly initial jobless claims. In addition to the yield of US bonds, these factors will affect the US dollar price and provide some growth for gold. To take advantage of short-term opportunities, traders will continue to examine broader market risk attitudes.

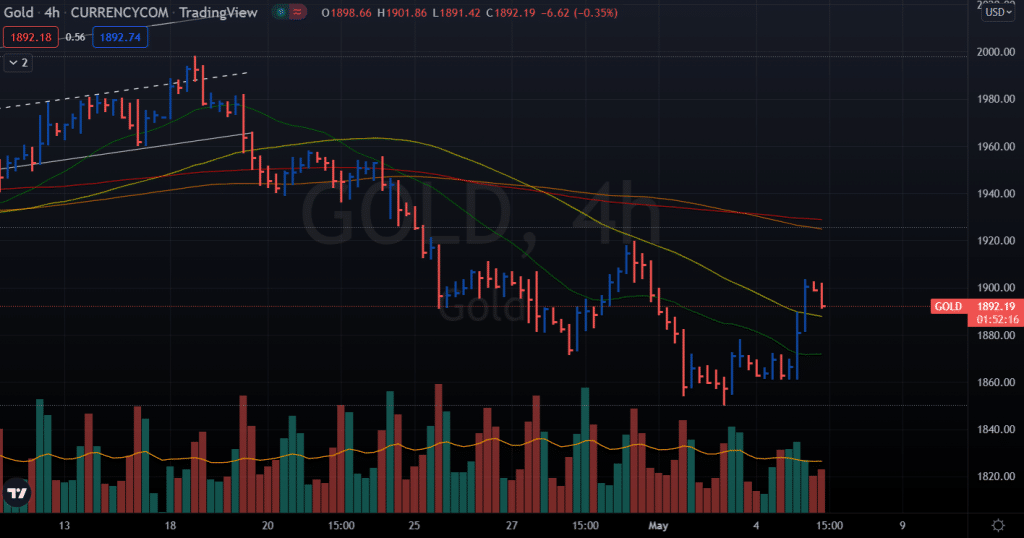

Gold price technical analysis: $1,900 remains a pivot

The gold price broke the $1,900 mark yesterday. However, the metal retraced on the day, moving towards the 50-period SMA. The next key support lies around the 20-SMA near the $1,870 area.

–Are you interested in learning more about Australian brokers? Check our detailed guide-

Alternatively, staying above the $1,850 area will attract more buyers. However, the key for the buyers is to find acceptance above the $1,900 mark.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money