- A bullish pattern should announce a new rebound.

- The US retail sales data and the Canadian CPI pushed the XAU/USD toward new lows.

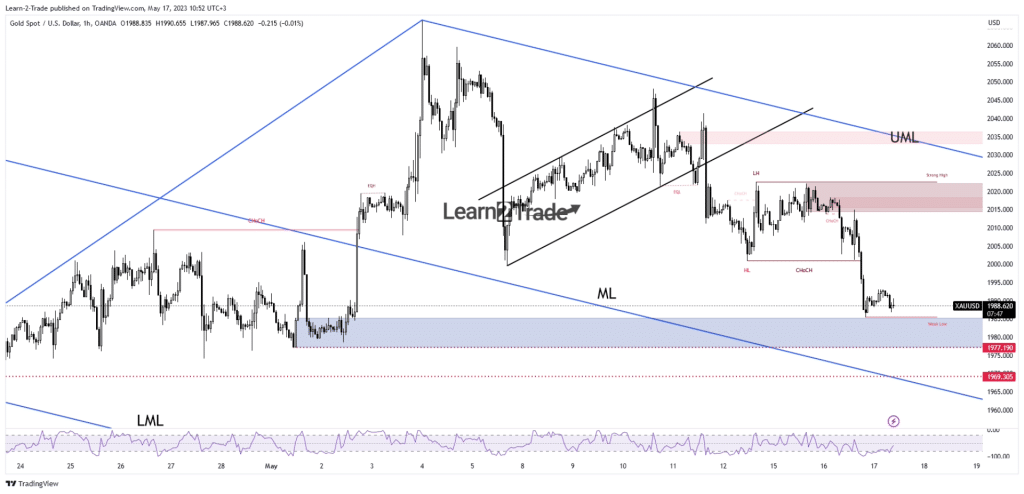

- $1,977 stands as a key support level.

The gold price dropped to $1,987 per ounce on Wednesday amid a stronger US dollar and positive economic data from the US and Canada.

The yellow metal faced strong selling pressure after breaking below the upward channel that supported its rally since August. The XAU/USD pair dropped sharply on Tuesday following the release of higher-than-expected inflation in Canada and retail sales in the US.

–Are you interested in learning more about day trading brokers? Check our detailed guide-

The Canadian Consumer Price Index increased by 0.7% in April, surpassing the forecast of 0.5%. The US and Core Retail Sales rose by 0.4% in April, beating the previous month’s figures.

Moreover, the US Capacity Utilization Rate matched the expectations of 79.7%, while Industrial Production exceeded the estimates of 0.0% and grew by 0.5%. These positive indicators boosted the demand for the greenback and weighed on the gold price.

Today, the Australian Wage Price Index was below expected at 0.8%, adding more pressure on the XAU/USD pair. Later, the US Building Permits and Housing Starts data will be released, which could further influence market sentiment.

Analysts expect a slight increase in Building Permits from 1.43 million to 1.44 million and a slight decrease in Housing Starts from 1.42 million to 1.40 million. If the data confirms or exceeds expectations, the US dollar could extend its gains and push the gold price to new lows.

The market will focus on the Australian Unemployment Rate and Employment Change data and the US Unemployment Claims report tomorrow. Both are high-impact events for the XAU/USD pair.

Gold price technical analysis: Facing major support levels

Technically, the XAU/USD pair is trading below a key resistance level at $2,022, the previous high tested in August. The pair has also broken below the upward channel that supported its uptrend since then.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

Currently, it is trading near a major demand zone from $1,977 to $1,969. This zone coincides with a historical level and the median line (ML) of a descending pitchfork that could act as strong support levels for the pair.

After a significant decline, a rebound is possible if the precious metal forms a bullish pattern within this zone. However, if the gold breaks below this zone, it could signal a continuation of the downtrend and open the door for further losses.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.