- Gold remains well bid as the Dollar suffers.

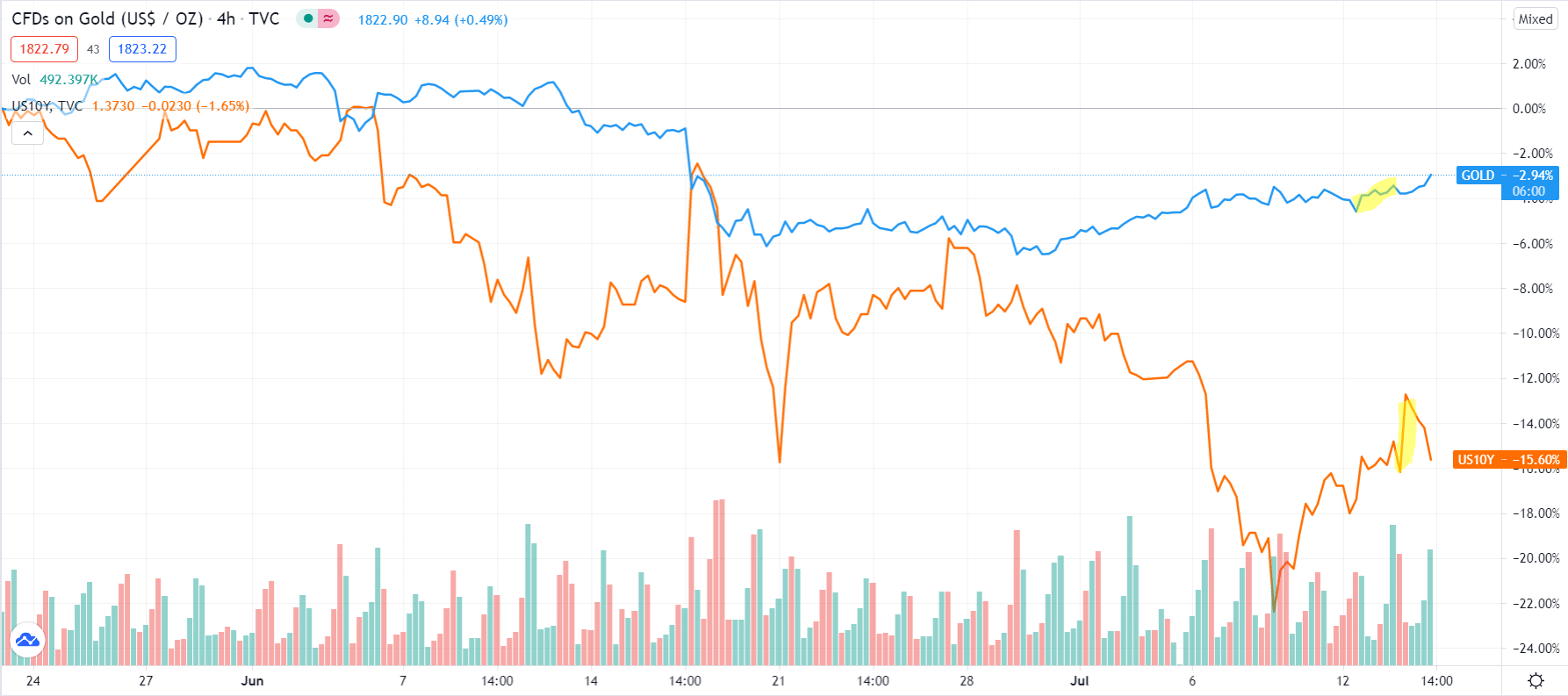

- Gold breaks the correlation with US Treasuries.

- Fed remains divided on monetary tightening.

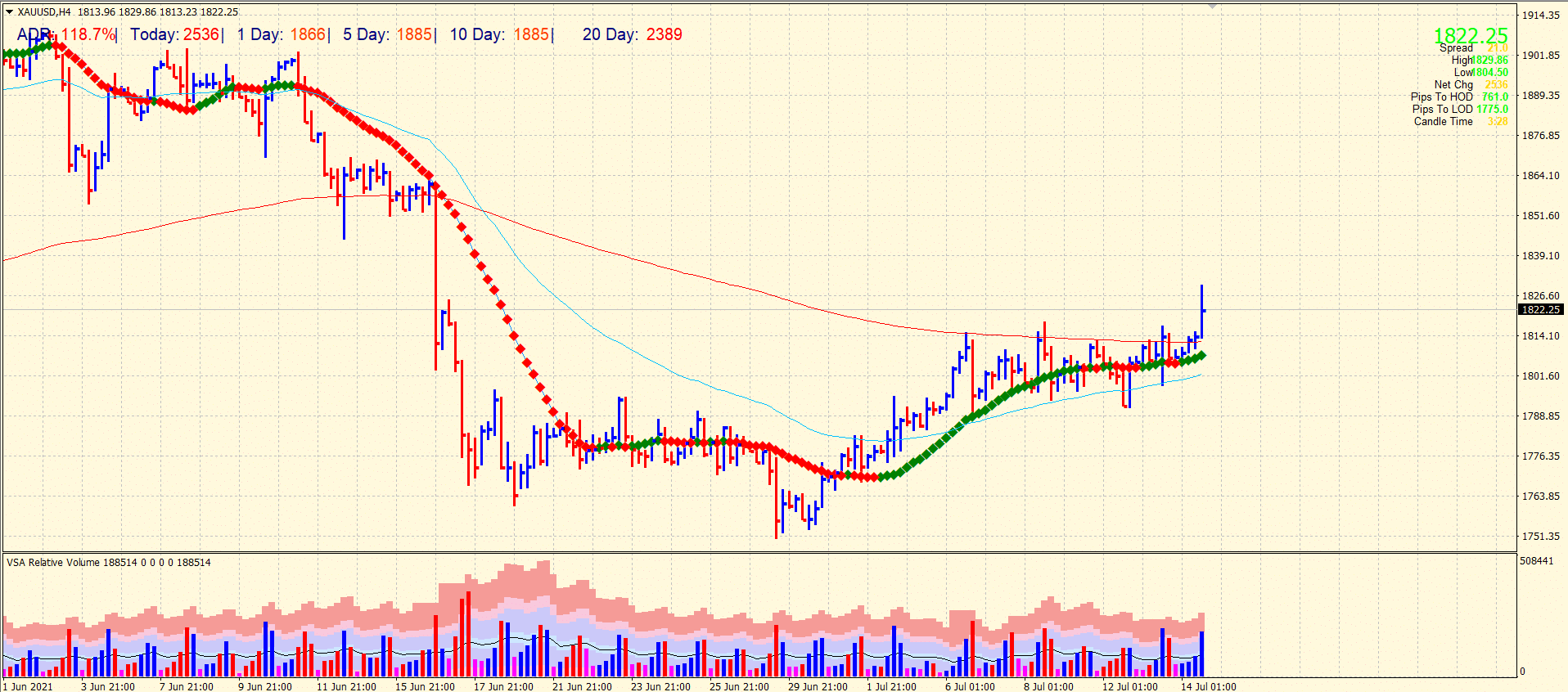

- Technically, the breakout has occurred provided the price remains above 200-SMA on the 4-hour chart.

Has gold price remembered its primary function of hedging inflationary risks? Or is it just tired of falling? Be that as it may, the precious metal, unexpectedly for many experts and investors, ignored both the strengthening of the US Dollar and the rise in US Treasury bond yields in response to the surprise from US consumer prices, which accelerated in June from 5% to 5.4% y / y.

-If you are interested in forex day trading then have a read of our guide to getting started-

Gold is traded against US Dollars. It is usually perceived as an anti-dollar asset. Therefore, an increase in the USD index leads to a decrease in prices for precious metal futures and vice versa. At the same time, the analyzed asset is not able to compete with interest-bearing bonds. Hence, an increase in rates on yields is a bearish factor for the XAUUSD. At the auction on July 13, these ties were broken. The US Dollar and US debt yields rallied, but gold seemed to ignore it.

In fact, the ideal environment for precious metals is periods of abnormally low or abnormally high inflation, accompanied by slow GDP growth, that is, the so-called stagflation.

In the first case, the Fed will continue to adhere to ultra-soft monetary policy for as long as possible. In the second, Fed will rack its brains. Is it necessary to shake off the arrogance of inflation while slowing down economic growth by raising rates, or not? That is why the XAUUSD bulls managed to find their ground after the June selling. Let me remind you that the first month of summer was the worst for gold in the last 4.5 years.

Indeed, labor market problems and a slowdown in business activity are forcing investors to question: Will the actual GDP recovery be as robust as expected? At the same time, the US economy is facing the fastest acceleration in core inflation since 1991.

Hence, opinions within the FOMC are divided. Someone thinks that the employment indicators have not yet been met so that QE can be rolled out. Someone, on the contrary, is calling for a quick abandonment of the quantitative easing program for $120 billion a month. They say that it is inflating a bubble in the real estate market, and it is time to take inflation by hand.

In my opinion, the US labor market in the fall due to the expiration of the validity of incentive checks will recover faster than in the summer. This will restore investor confidence in the strength of the American economy and push the Fed to take decisive action. As a result, the US Dollar will strengthen on expectations of monetary policy normalization, while gold will go down. However, the split in the ranks of the FOMC does not exclude the possibility of its short-term strengthening. Especially if Jerome Powell remains committed to the dovish position in his speech to Congress.

Today’s solid PPI figures of the US could not help the gold bears. However, even the major currencies remained unaffected.

Gold price technical analysis: Breakout or fake out?

The gold price managed to break above the weekly highs and 200-period SMA on the 4-hour chart. The volume is very high, encouraging more buyers to enter the market. The average daily range of the metal has already reached 118%. It means we are already done for the day unless Powell’s speech provides fresh stimulus to the market.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.