- Gold is supported ahead of what is expected to be a busy day for markets.

- The Fed is on tap and it matters a great deal for the precious metal.

- Gold Weekly Forecast: XAU/USD tests key trend line ahead of FOMC meeting

The precious metals sector struggled overnight as investors position for a possible shift in monetary policy from the Fed.

Gold prices were down some 0.4% in the final part of the North American day as the US dollar firmed ahead of the outcome of the Fed’s two-day meeting on Wednesday.

XAU/USD was trading between a range of $1,851.66 and $1,869.20. At the time of writing, the price is flat and establishing with a technical bias to the upside.

The price has otherwise been crimped by a stronger US dollar and higher yields on US Treasuries.

The US 10 year yield was 0.5bps higher at 1.49% while DXY ranged between 90.3/67, poised for a downside correction according to the W-formation on the daily chart:

Meanwhile, data on Tuesday was fuelling the bid for the greenback while otherwise, the markets had been pricing for a dovish Fed for longer considering the communication to date by Fed officials.

”While the market isn’t expecting the Fed to start tapering its bond purchases at this meeting, it will be looking at the dot plot for any signals it may be thinking about raising interest rates in 2023 amid higher inflation and stronger economic growth,” analysts at ANZ bank said.

Members have insisted that rising inflationary pressures are transitory and ultra-easy monetary settings will stay in place for some time. The Fed’s Chair, Powell, is expected to say that the most likely course is that inflation decelerates over the coming months, settling back at more normal levels later this year.

On the other hand, if there are upward revisions for PCE inflation in 2021 then this could be feeding through to a more sustained rise in inflation over the medium term.

This would be more hawkish than what the markets are priced for and most probably weigh on precious metals.

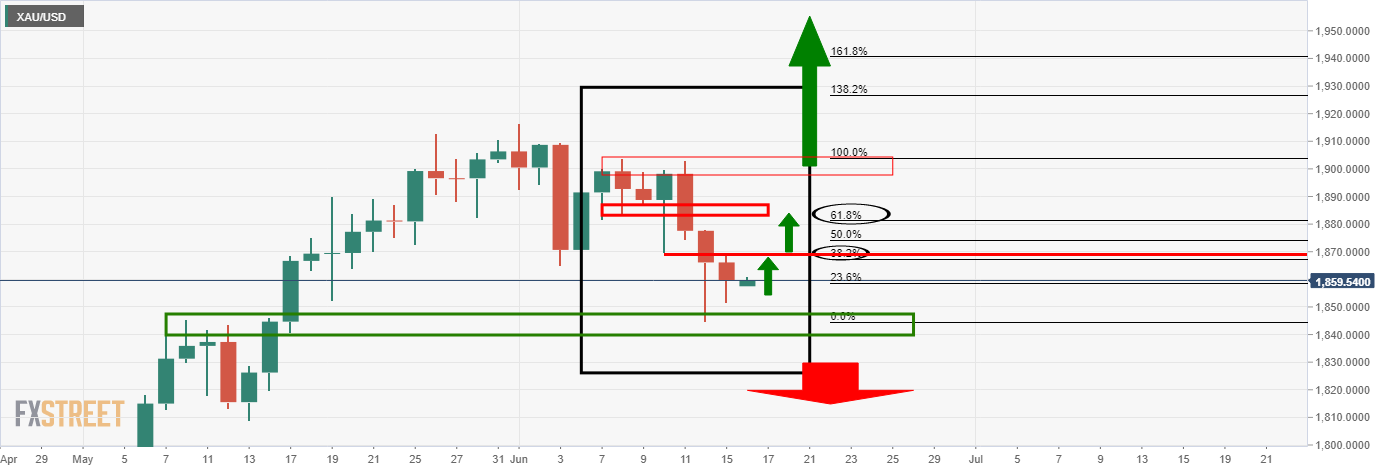

Gold price analysis

Technically, the M-formation on the daily chart is compelling.

Bulls can target a retracement to at least the 38.2% Fibo at 1,867 although the structure aligns better with the 61.8% Fibo at 1,880, in line with the 10-day EMA.

The higher low on the 4-hour chart should also be encouraging for the bulls.