- The Federal Open Market Committee’s two-day policy meeting is scheduled for September 21 and 22.

- On Tuesday, the gold price forecast remained bullish above the 1,745 support level, which is the double bottom level.

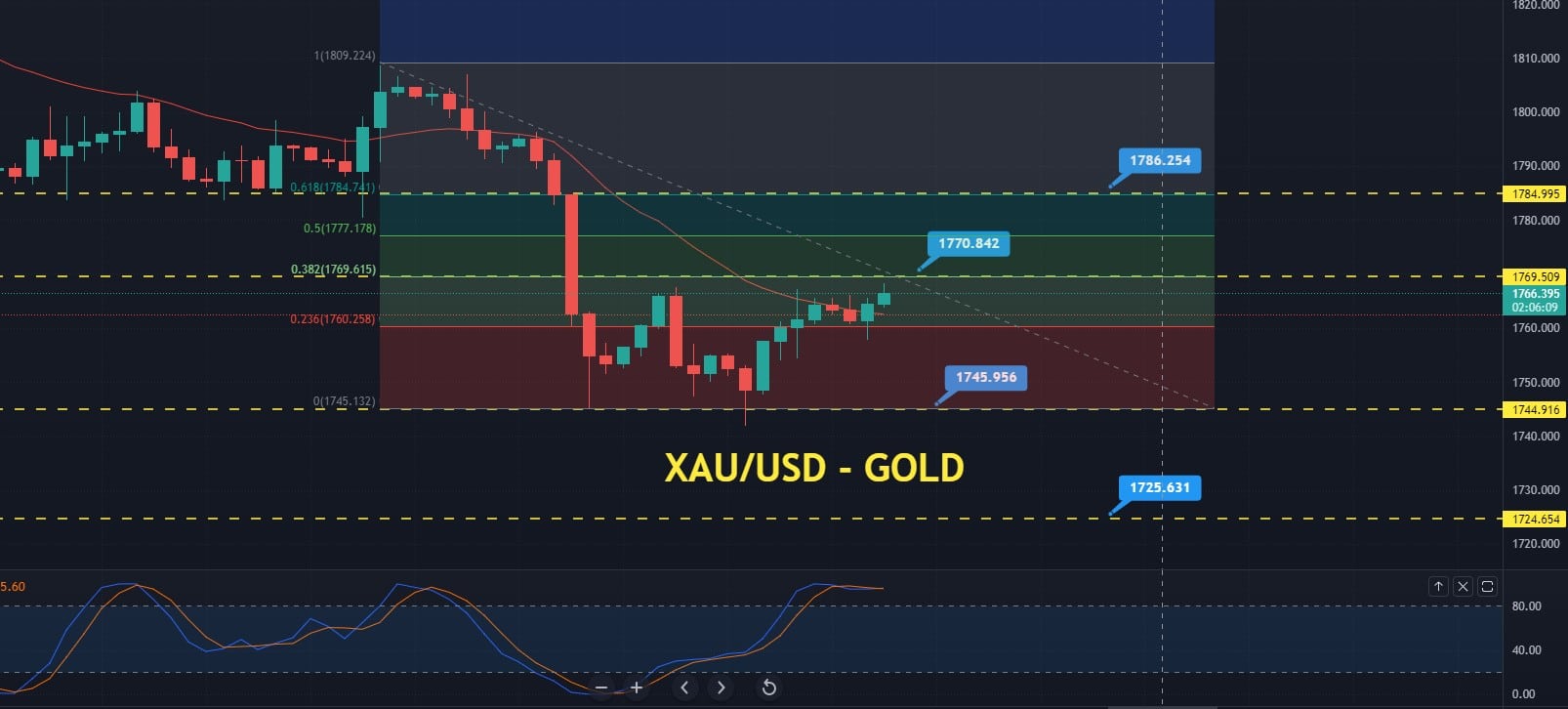

- Forex trading market participants may sell below the $1,770 level to target the $1,760 and $1,755 levels.

Gold prices remained unchanged on Tuesday as investors remained cautious ahead of the US Federal Reserve’s policy meeting, when the central bank is anticipated to reveal clues on when it will start tapering its asset purchases. On Tuesday, the gold price forecast remained bullish above the 1,745 support level, which is the double bottom level.

If you are interested in trading XAU/USD with forex robots, check out our guide.

Bullion is a hedge against inflation and currency depreciation and these both are likely to occur due to the widespread stimulus. The appeal of gold would be diminished if the Fed became more hawkish. Moreover, an eventual interest rate hike would boost the opportunity cost of holding the non-interest-bearing asset.

Gold Steady in the United States at $1,764.40

Concerns about the financial consequences of Evergrande’s solvency difficulties frightened financial markets and boosted the dollar index. Thus, it hit a near one-month high on Monday. For holders of foreign currencies, a stronger dollar makes bullion more expensive.

At its policy meeting on Wednesday, the Fed may provide an outlook on how soon and how often it believes the economy will require interest rate hikes over the next three years when it announces updated forecasts.

The ECB’s bond purchases are becoming “less essential.”

According to ECB board member Isabel Schnabel, the scale of the European Central Bank’s bond purchases is becoming “less essential” as the economy strengthens and the money-printing plan becomes a tool for guiding rate expectations.

According to Stephen Innes, managing partner at SPI Asset Management, the market is beginning to believe that a taper announcement is coming and that there could be a hawkish surprise in the dot plots.

As a result of a widespread stimulus, the bullion is viewed as a hedge against expected inflation and currency depreciation. The Fed’s tapering might address both of these issues, lowering gold’s appeal. As equities market futures rose on Tuesday, the dollar retreated from a one-month high, as investors fearing a potential default by property developer China Evergrande sought protection in the yen.

FOMC Preview and Dollar Outlook

The Fed will also release its quarterly economic projections, which will include, for the first time, figures for 2024. Furthermore, most traders and economists predict that the median “dot” for interest rate liftoff from near-zero percent rates will remain in 2023. While it would only take a couple more hawkish members to shift the median “dot” to next year.

Besides, the Fed will also give an update on how it perceives economic growth, unemployment, and inflation developing over the next few years. Given the Fed’s track record of poor economic forecasting, any changes to those forecasts will undoubtedly be scrutinised for clues about which way the monetary policy winds are blowing.

The dollar held steady at 93.190 against a basket of competitor currencies after hitting its highest level since August 23 at 93.45 in the previous session. Equities futures in the United States were up 1%. Investors were cautious as markets recovered from Monday’s selloff. A currency market volatility index (.DBCVIX) hit new highs for the first time since late July.

Gold Price Forecast – Daily Support and Resistance

Support Resistance

1751.85 1756.00

1749.45 1757.75

1747.70 1760.15

Pivot Point: 1753.60

Gold Price Forecast – FOMC in Highlights

The gold price forecast remained bullish above the $1,745 support level, the double bottom level. The closing of candles below the pivot point resistance level of 1753.60 also provides significant pressure on gold.

Oversold gold has already completed a 38.2% Fibonacci retracement at $1,768 levels, and it fell right after. Gold triggers a bullish bounce-off as it is rejected at the 1,745 level which marks a double bottom level support level. Further, on the higher side, the next resistance will prevail at the $1760 level that marks the 23.6% retracement for gold.

In the 4- hour timeframe, the 50-day EMA may provide resistance at the 1,766 level. Furthermore, the leading indicator, Stochastic RSI, remains below 50, indicating a strong gold-selling trend. Therefore, Forex trading market participants may sell below the $1,770 level to target the $1,760 and $1,755 levels. Alternatively, traders can take a buy position above the $1,772 level today. All the best!

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.