- The price of gold maintains a bullish bias despite temporary retreats.

- XAU/USD could develop a new leg higher if it stays above the uptrend line.

- After its massive drop, a new swing higher is on the cards.

The gold price plunged in the short term after failing to test 2,075.28 key resistance. Technically, a temporary correction was natural after its strong rally.

–Are you interested in learning more about copy trading platforms? Check our detailed guide-

However, the rate came back down to retest the immediate support levels before developing a new leg higher. The metal is trading at 2,006.83 at the time of writing way above 1,970.52 yesterday’s low. As you already know, XAU/USD is used as a safe-haven during these geopolitical tensions. Therefore, gold remains attractive for buyers despite temporary declines.

In the short term, XAU/USD also plunged because the traders expected diplomatic solutions to end the war in Ukraine. The yellow metal rallies, but it remains to see how it will react later around the ECB and after the US inflation data is released. The European Central Bank keeps its monetary policy unchanged as expected. The Main Refinancing Rate remains steady at 0.00%. Still, the ECB Press Conference could bring high volatility and sharp movements.

Gold is used to hedge inflation, so the US inflation figures could shake the price. For example, the Consumer Price Index is expected to register a 0.8% growth in February versus 0.6% growth in January, while the Core CPI could report a 0.5% growth. In addition, the US Unemployment Claims indicator is expected at 220K in the last week higher versus 215K in the previous reporting period.

Gold price technical analysis: Corrective phase

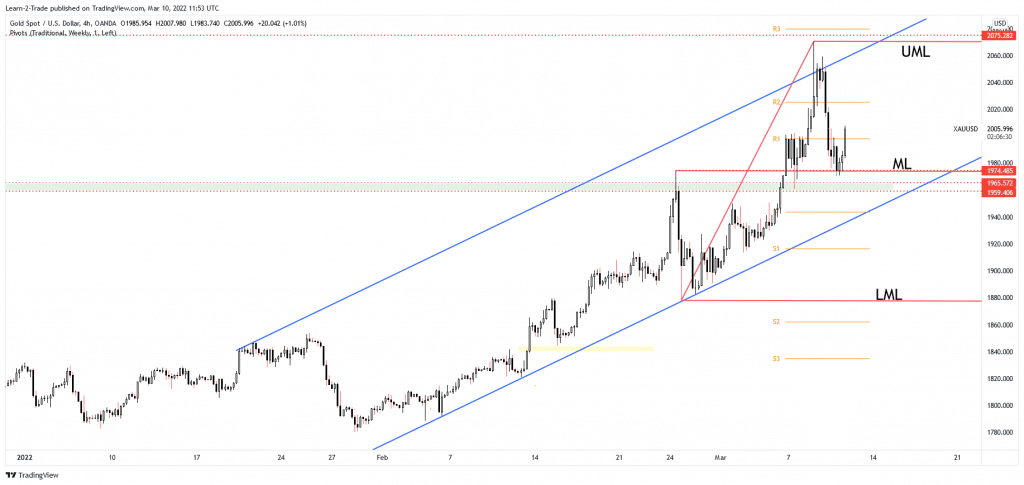

The price of gold found support right on the 1,974.48 former high and on the pitchfork’s median line (ML). It has jumped above the 2,000 psychological level and above the R1 (1,998.34), representing upside obstacles. Technically, the bias remains bullish as long as the rate stands above the uptrend line.

–Are you interested in learning more about scalping forex brokers? Check our detailed guide-

After its massive drop, a new leg higher is on the cards as the price could try to recover. The 1,965.57 – 1,959.40 area is seen as a demand zone. Strong consolidation could announce that the downside movement ended and that the buyers could take the lead again. As long as it stays within the channel’s body, XAU/USD could develop a new swing higher.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money