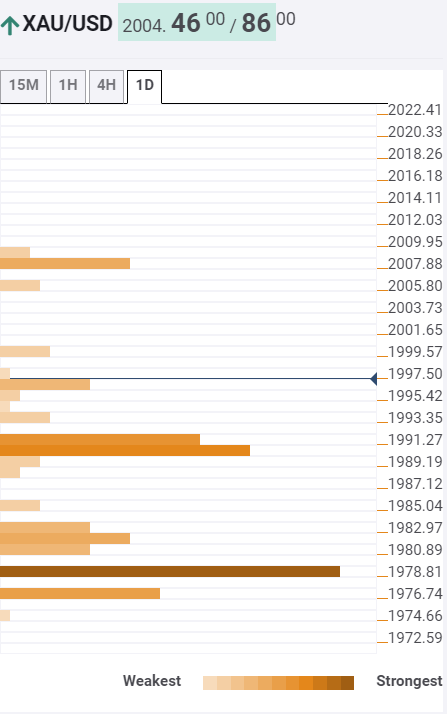

Breaking: Gold breaks above $2000, further upside in play – Confluence Detector

Gold trades on a solid footing and regains the critical $2000 mark, as the US dollar remains intrinsically weak on several fronts specific to the US. The Treasury yields remain pressured amid dwindling economic recovery and fiscal stand-off.

Meanwhile, the safe-haven gold benefits from renewed US-China tensions on the Hauwei issue. Investors also look for safety in gold ahead of Wednesday’s FOMC minutes. Let’s look at the key technical levels for trading the gold’s latest run higher. Read more…

Gold to surge toward $2300 amid geopolicital tensions – UBS

After reaching a record high of $2,051/oz in early August, gold suffered its largest one-day decline in seven years on 11 August, dropping back below $1,900/oz. Gold has already recovered to $2,000/oz. The bout of profit-taking in gold is short-lived as noted by economists at UBS who believe a bounce towards $2,300/oz is on the cards.

Key quotes: “Gold’s sell-off was driven by a rebound in 10-year real rates after falling to record lows in negative territory. Demand for gold this year has been driven mostly by record inflows to gold exchange-traded funds, so the price reaction was exaggerated and should be seen in the context of the sharp price runup prior to the pullback.” Read more…

Gold regains $2000 level, technical set favors bulls ahead of US housing data

Gold extends the advance and has just broken $2000 level, having closed above the critical 100-hourly SMA at $1941 on Monday. XAU bulls continue to benefit from dollar weakness and falling T-yields. What’s more, US-China tussle could offer further support to the yellow metal, FXStreet’s Dhwani Mehta reports.

Key quotes: “The bright metal will continue to draw support from broad-based US dollar weakness amid falling Treasury yields and nervousness ahead of Wednesday’s FOMC minutes. Meanwhile, any escalation on the US-China front could bode well for the safe-haven gold. The focus will be on the US housing data for fresh cues on the economy, especially after the disappointing US Retail Sales and regional manufacturing data undercut the nascent economic rebound.” Read more…