- Gold prices remain stable above the $1800 as Fed tapering speculations lose interest.

- Fed’s tightening is the key to drive the gold prices.

- Technically, the price looks poised to break the double top at $1831.

The gold price outlook is bullish as the price is stable above the $1800 level. In addition, the risk-off sentiment and speculations about FOMC are lending support to the metal.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

The minutes of the July meeting of the Federal Reserve System came out last week. According to him, the Fed begins to discuss a reduction in asset purchases at the end of this year. This drove stocks down as traders continue to expect the Fed to tighten monetary policy. The hardest hit were economically sensitive cyclical stocks and anything that was part of reflationary trading.

The Fed hasn’t said anything new that hasn’t been mentioned by other FOMC members in their various negotiations.

Nevertheless, according to all experts, the Fed is alarming. So, they plan to tighten up. And as they tighten policy, inflation is no longer a concern.

The expert noted that the markets are reacting to this expected tightening cycle in the same way as previous ones, not noticing the difference between them. In fact, the Fed’s next move can hardly be called a “tightening cycle.”

So far, the only thing that has happened during this cycle is the Fed’s statement. That’s all. These are all conversations, not actions.

So, this is not entirely accurate. They may never start cutting back. So, the only thing we get is talk of cuts, and in fact, that could be the whole tightening cycle because, by the time the Fed actually gets to cuts, it will be too late. The economy may already be in decline. Markets may already turn down, in which case any plans for cuts will have to be revised because the Fed is essentially hostage to the markets and the economy.

This is not to say that this is a normal tightening cycle and therefore negatively affects gold if all we can get is talk. So why is it bad for gold?

Gold should rise right now, based on the reality of what is about to happen, not on the fantasies caused by the Fed’s talk. And he believes that even if the Fed does indeed begin the process of cutting the asset-buying program, it is unlikely that it will end it.

The Fed currently buys about $ 120 billion a month in assets split between US Treasury bonds and mortgage-backed securities. The only thing we know about this mythical cut so far is that the Fed is planning to cut both assets equally, rather than favoring one, and that this could happen this fall. Maybe.

The Fed has also done its best to emphasize that the decline in asset purchases does not mean that the regulator is close to raising interest rates. The central bank is unlikely to ever raise rates, given that it only managed to raise rates to 2.5% during the last tightening cycle before breaking the back of an overleveraged economy. In the previous cycle, the Fed raised rates to 5%.

If they were able to get 2.5% last time, then it makes sense that they will not be able to raise them at all. In fact, the only thing they can do this time around is to cut quantitative easing. Because last time they were able to cut asset purchases and raise rates. This time, at best, they can only do the first.

–Are you interested to learn more about forex signals? Check our detailed guide-

The moderate cut does not end the inflationary monetary policy. Instead, the Fed will simply inflate the bubble a little slower. It looks like a faucet pouring water into a bathtub. If you turn the handle halfway back, water will still flow into the tub. It will still fill and overflow.

Simply put, less soft does not mean tough.

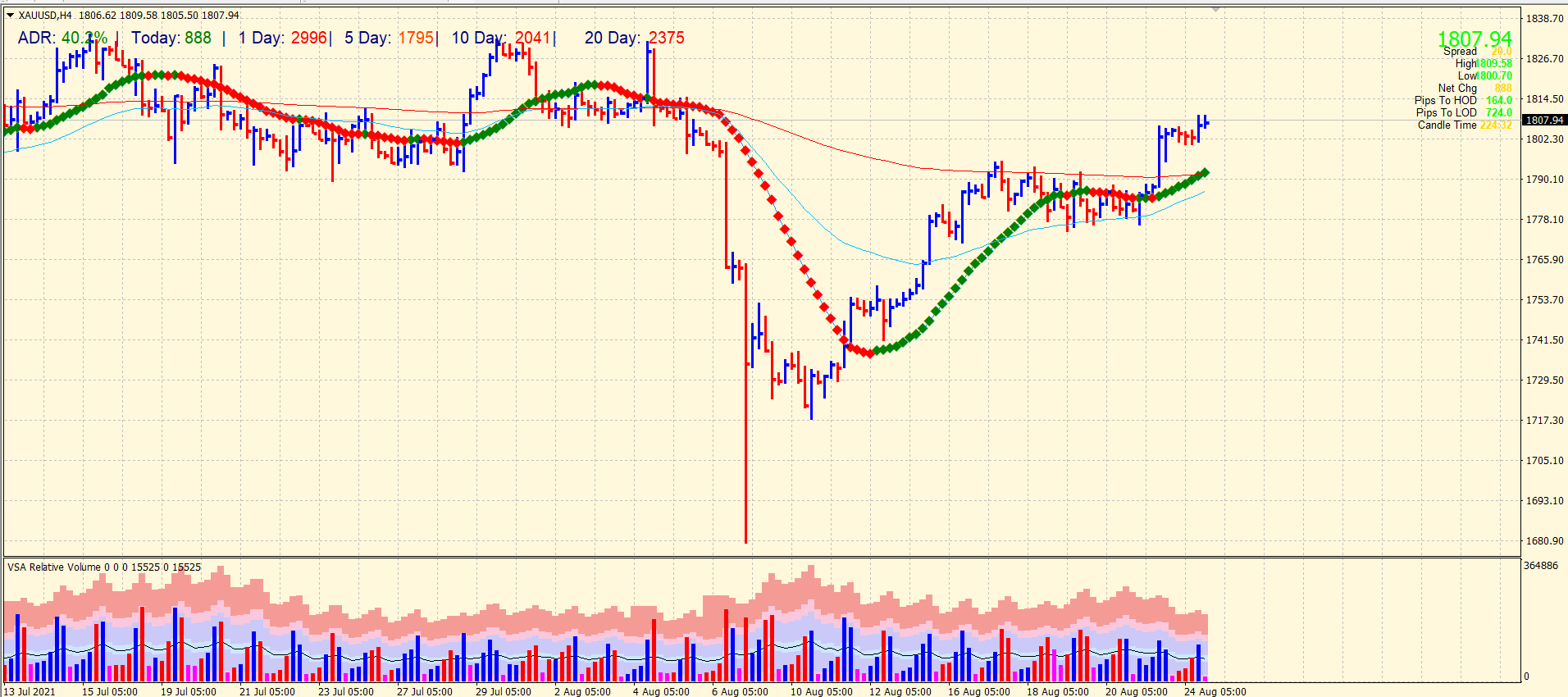

Gold price technical outlook: Looking to break the double top

The god price is well above the $1800 mark. Although the price has covered only 40% of the average daily range so far, the yellow metal looks positive to gain further. The price is above the key SMAs like 20, 50, and 200 SMAs on the 4-hour chart. The price may look to break the double top at $1831.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.