- The XAU/USD could jump higher if it stays above the uptrend line.

- A new higher high could bring new long opportunities.

- The UK and the Canadian inflation data could bring sharp movements.

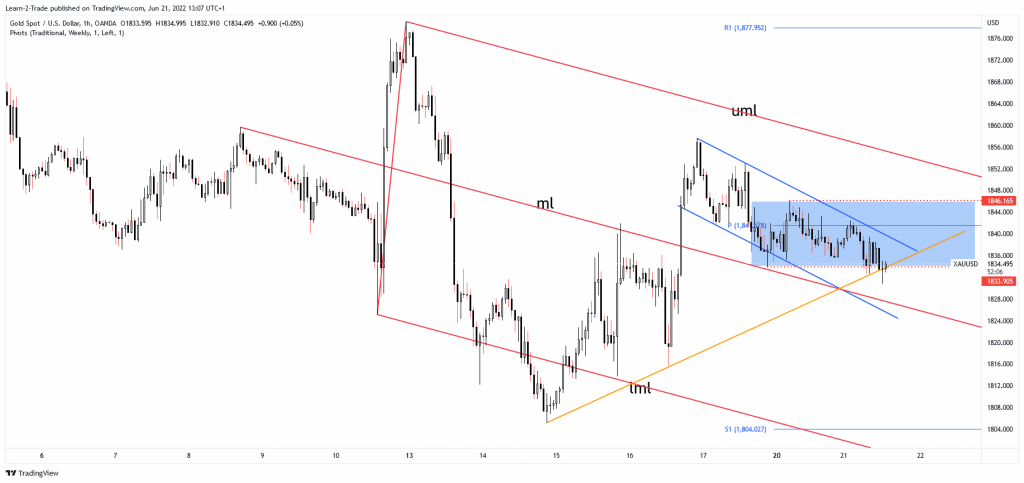

The price of gold dropped in the short term after reaching the 1,857 level. Technically, a temporary drop was natural after its last rally. The price action developed a down-channel pattern representing an upside continuation pattern.

-Are you interested in learning about forex live calendar? Click here for details-

In the short term, the yellow metal seems heavy as the Dollar Index tries to come back higher. When the DXY rallies, the XAU/USD could slip lower or move sideways. Gold reached a strong confluence area, so it remains to see how it will react.

Fundamentally, the XAU/USD rallied after the FOMC decision to increase the Federal Funds Rate by 0.75%. Today, the Canadian retail sales data also brought some gold volatility. The Retail Sales indicator reported a 0.9% growth versus the 0.8% expected, while the Core Retail Sales rose by 1.3% compared to 0.5%.

Later, the US Existing Home Sales are expected to be at 5.40M below 5.61M in the previous reporting period. Tomorrow, the price of gold could register sharp movements as the UK and Canada release the inflation figures.

The UK CPI is expected to report a 9.1% growth in May versus 9.0% in April. The Canadian Consumer Price Index could register a 1.0% growth versus only 0.6% in the previous reporting period.

Gold price technical analysis: Flag pattern

From the technical point of view, the XAU/USD developed a down channel, a flag formation that could represent a bullish pattern. In the short term, it’s trapped between 1,846 and 1,833 levels. Escaping from this range could bring new opportunities. Now, it has found support right on the up trendline.

-Are you interested in learning about forex signals? Click here for details-

The price reached the confluence area formed at the intersection between the 1,833 and the uptrend line. A false breakdown through this confluence area could signal new bullish momentum. Still, a larger growth could be activated only by a valid breakout above the 1,846. On the other hand, a valid breakdown through the confluence area, a new lower low could activate more declines.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money