- As gold gains momentum for the second day in a row, it continues to recover from a monthly low.

- Falling US bond yields weighed on the US dollar and boosted the underperforming yellow metal.

- As a result of risk appetite and the Fed’s dovish outlook, the XAU/USD pair should continue to decline.

Gold price gained some follow-on momentum after the FOMC meeting on Wednesday, recovering from a fresh monthly low below $1,900. Early in the European session, the XAU/USD pair posted modest intraday gains and traded near a daily high of $1935. As investors ignored the long-awaited Fed decision, dollar bulls were put on the defensive by a fall in US Treasury yields, which provided a tailwind for the dollar-denominated commodity. However, it’s in danger of fizzling out quickly because there has not been a clear fundamental catalyst for growth.

–Are you interested in learning more about making money with forex? Check our detailed guide-

Fed’s rate hike of 25 bp

Since 2018, the Federal Reserve raised its interest rate target by 25 basis points on Wednesday for the first time. The Fed is also planning more aggressive policy actions to combat persistently high inflation. In fact, the Fed could raise rates at all six meetings remaining in 2022. At a press conference following the meeting, Jerome Powell said that the Federal Reserve could start cutting its nearly $9 trillion balance sheet. The balance is already in place at the next meeting in May, which should discourage meaningful gains from unprofitable gold.

Russia-Ukraine to reach peace

Bulls may continue to refrain from aggressive wagers despite signs of progress in the ceasefire talks between Russia and Ukraine. Volodymyr Zelenskyy, the Ukrainian president, said that the talks were becoming more realistic, while Russia noted that the proposals under discussion were close to an agreement. There is hope for a diplomatic solution to end the war in Ukraine, which could dampen safe-haven gold gains. For this reason, it would be prudent to wait for strong subsequent buying before concluding that the strong pullback from the $2070 area or the highest since August 2020 is over.

What’s next for the gold price?

The market now awaits the release of the US economic report, which will include the Philadelphia Fed Manufacturing Index, initial jobless claims, and industrial production data. The release of these data and US bond yields could impact the US dollar. In addition, to capitalize on some short-term gold-related opportunities, traders will also consider recent developments surrounding the Russia-Ukraine saga and the broader market risk sentiment.

Gold price technical analysis: Bulls seem limited

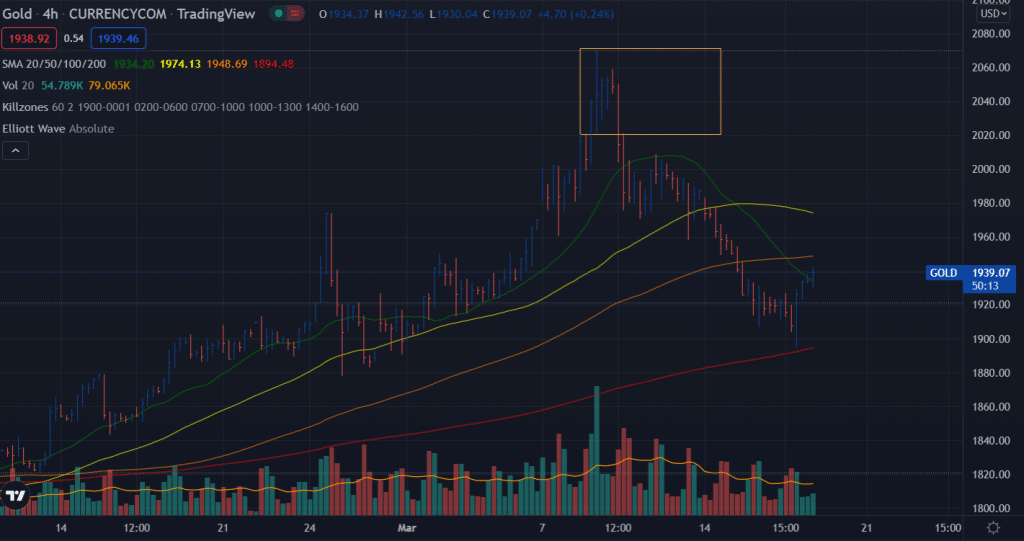

The gold price respites at 200-period SMA (4-hour chart) and posted a strong shakeout bar. The metal has jumped above the 20-period SMA as well. However, the volume for the post-shakeout bars is quite below the average. The 50 and 100 periods SMAs are still pointing south. The next key resistance for the yellow metal is $1,950.

On the flip side, $1,900 will remain key support for the metal. If the support is broken, a swing low of $1,875 will be the next target ahead of $1,850.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

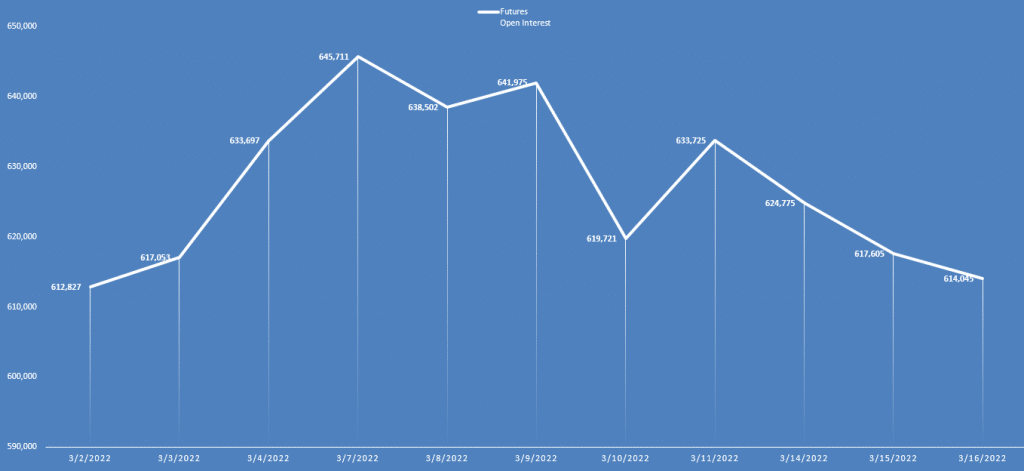

Gold price analysis via daily open interest

The gold price dropped while the open interest dropped too. It shows that the bears are weak, and the upside could be very likely.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money