- Gold drops to a low of $1,416 on the back of today’s rate cut.

- Todays cut was a ‘mid-cycle adjustment’, according to Powell.

The Federal Reserve cut rates by 25 basis points today in what Powell called a ‘mid-cycle adjustment’. In addition to cutting because of a global slowdown and a desire to recentre inflation expectations, Powell has said that today’s cut was an insurance cut to ensure against downside risks in trade. Powell also feels there are signs of weak investment and manufacturing as a result of such risks already. As a result, gold prices have dropped 1% on the decision, statement and a presser that is currently still in sessions.

-

Powell speech: Weak global growth, trade policy uncertainty and muted inflation concern Fed

- Fed’s Powell: Current rate cut decision differs from the start of a ‘lengthy cutting cycle’ (That’s bullish for the Dollar)

Federal Reserve outcome

- The interest rate on excess reserves cut to 2.10% from 2.35%.

- FOMC cuts benchmark rate by 25 basis points (bps); target range stands at 2.00% – 2.25%.

- To conclude b/sheet reduction in august, 2-months earlier than previously indicated.

- To roll over at auction all principal payments from holdings of treasury securities, reinvest all principal payments from agency debt and agency MBS received each month.

- Principal payments from agency debt and agency mortgage-backed securities (MBS) up to $20 bln/month will be reinvested in treasury securities to roughly match maturity composition of outstanding Treasury securities.

- Principal payments from agency debt and agency mortgage-backed securities in excess of $20 bln will continue to be reinvested in mortgage-backed securities.

- Rate cut supports the committee’s view that sustained economic expansion, strong labour market and near-target inflation. are most likely outcomes but uncertainties remain.

- As it contemplates future path of fed funds rate it will continue to monitor incoming info, act as appropriate to sustain expansion.

- Household spending growth has picked up, but business fixed investment growth has been soft and inflation compensation measures remain low.

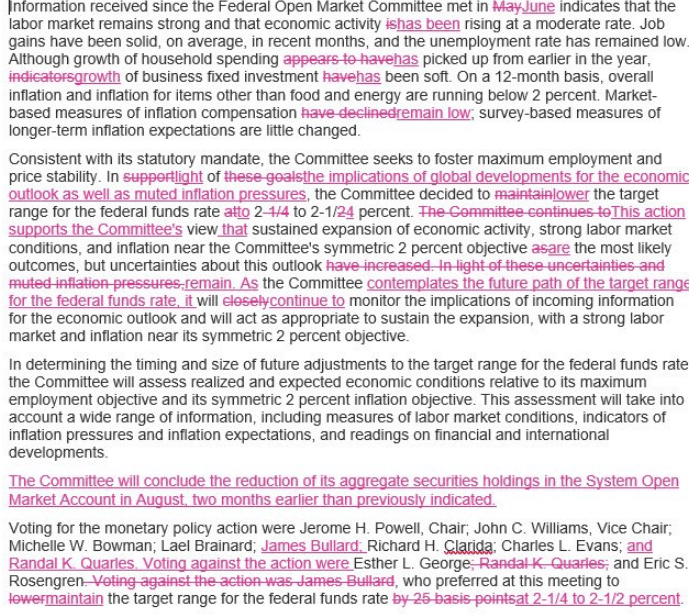

Statement comparison

The statement between the June 19 statement and the July 31 statement is pretty much identical hence we can expect a stronger dollar for longer unless the evolution of trade uncertainty, low inflation, global growth and the domestic economy deteriorate. However, gold should find support on global uncertain regardless.

Gold levels

Gold has dropped over 1% on today’s Federal Reserve decision. Prices have stabilised around the 20-day moving average at 1414.40 and the 1400 round number remains intact still, a level that is back-up by a confluence of Fibos lining ahead of 1382 swing lows. Should the Dollar continue to pick up steam, with markets now looking to this week’s Nonfarm Payrolls at the end of the week, then gold should find a soft patch around 1400 the figure.