- Spot Gold has rallied $11 bucks as the FOMC prepares to cut rates if necessary.

- Gold is currently trading 0.26% higher at $1,350, supported by the 50-4HR MA.

Gold continues to move higher along the 50-4HR MA and the testing five-year long resistance line, buoyed by prospects of an easing Federal Reserve with plenty of geopolitical risk left on the table, despite a recent acknowledgement from the markets that Trump and Xi will meet at the G20 later this month.

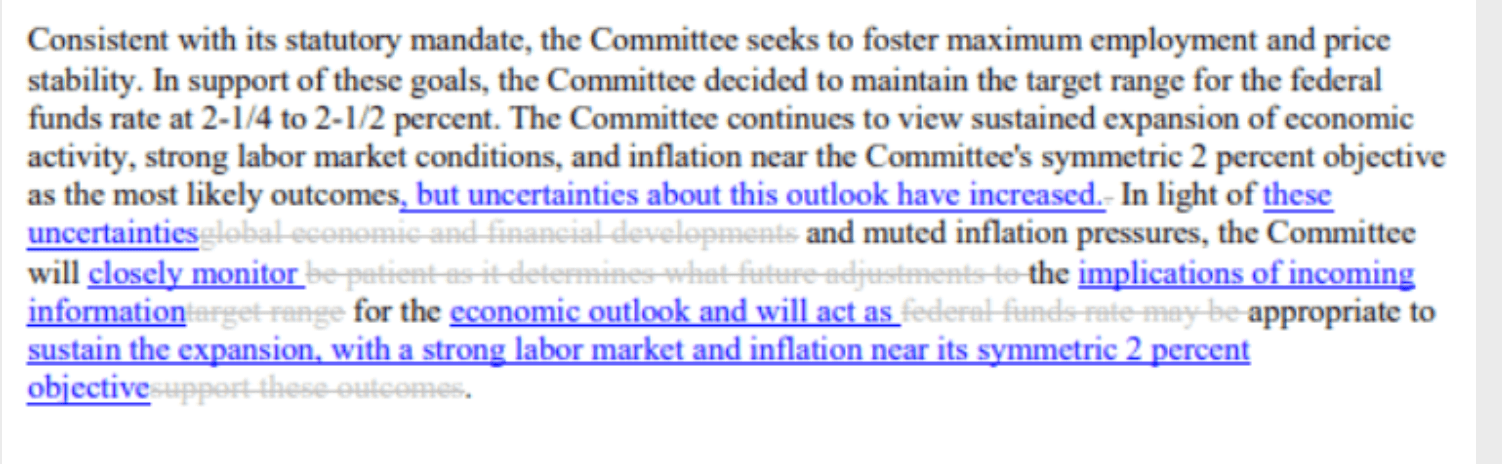

Meanwhile, immediate attention is on the Federal Open Market Committee’s meeting, (FOMC) and Powell’s presser about to take place. The FOMC has left rates and policy on hold, as expected, but has signalled to the market an easing bias by dropping language saying it would be ‘patient’ on future policy adjustments and that they are closely monitoring and will act as appropriate. The balance sheet roll off will proceed as planned. Gold, which is correlated to the bond market which was already expecting significant rate cuts for this year, has moved higher with the 10 year US yield falling to 2.038% from a prior range of between 2.0530% and 2.0990%, well down from the 2019 high of 2.80%.

-

CME FedWatch Tool shows 89% chance of a 25 bps rate cut in July

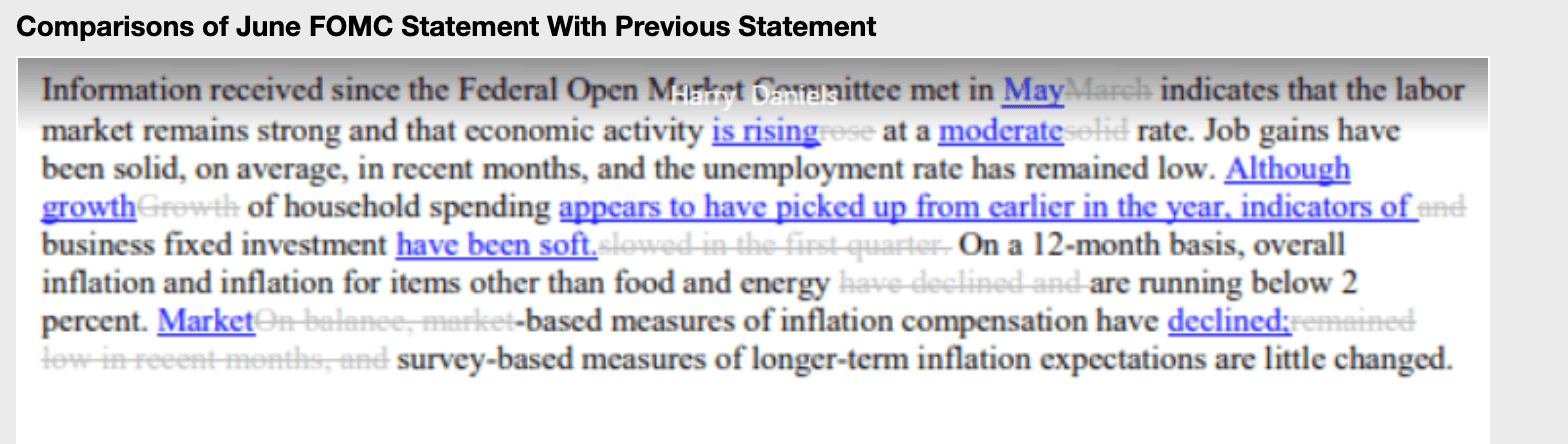

Statement comparison:

FOMC main takeaways:

- Interest rate on excess reserves unchanged at 2.35%.

- Benchmark interest rate unchanged; target range stands at 2.25-2.50%.

- Drops language saying it would be ‘patient’ on future policy adjustments.

- Uncertainties have increased regarding outlook for sustained economic expansion.

- 9:1 policy vote, Fed’s Bullard dissented because he wanted a rate cut

- To act as appropriate to sustain econ. expansion with a strong labour market, inflation near target

- Economic activity is rising at a moderate rate

- Household spending appears to have picked up but business fixed investment has been soft

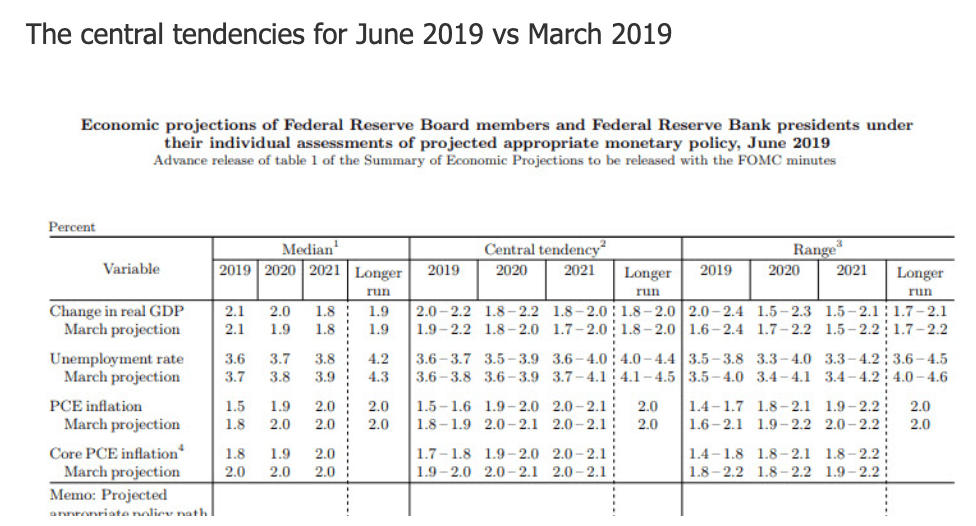

Dot Plot

Gold levels

Gold has rallied towards Jan 2018 highs of 1366, and on course towards the five-year highs at 1375. Further out, the Sep 2013 highs are located in the 1435s. On a correction 1346 guards, 1333 and then the 1320 level comes ahead of 1311. Below there, 1303/06 will open 1297. 1297 level meets the 50% Fibo retracement of the late April and early May double-bottom swing lows to recent spike high. The 200-week moving average comes in at 1250s.