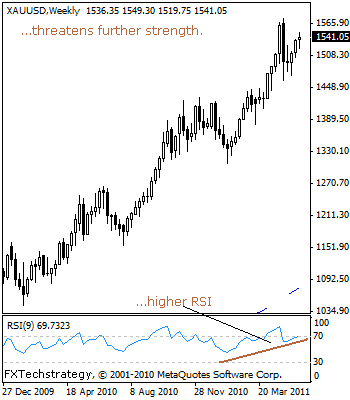

GOLD Holds On To Its Bullish Tone

GOLD: Outlook for Gold still remains higher despite its marginal higher close the past week.

Further strength is expected to recapture the 1,576.20 level, its 2011 high where a break will resume its long term uptrend and open the door for more gains towards its psycho level at 1,600 and then the 1,650.00 level.

Guest post by www.fxtechstrategy.com

Its weekly RSI is bullish and pointing higher suggesting further strength. On the downside, support resides at the 1.526.26 level, its May 11’2011 high where a reversal of roles as support is likely to occur but if that fails to materialize, further weakness will occur towards the 1,470.00 level and then the 1,462.15 level, its May 05’2011 low.

Further down, its .618. Fib Ret (1,380.85- 1,576.20 rally) at 1,455.00 comes in as the next downside target.

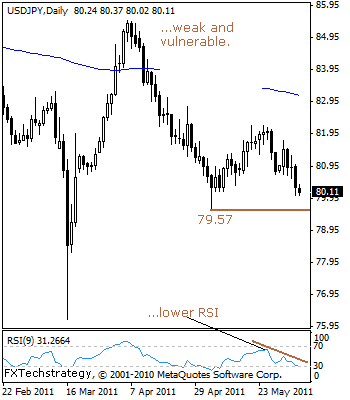

USDJPY: Under Pressure, Risk Turns To 79.57 Level.

USDJPY: Having closed lower the past week and opened the new lower in early trading today, risk of further weakness cannot be ruled out.

USDJPY has been under pressure since losing upside momentum at the 85.49 level in early April’2011.

This technical development leaves the 79.57 level, its May 05’2011 low being targeted where a halt is expected.

However, if that level fails to hold, further weakness should develop towards its psycho level at 78.00 and ultimately the 76.18 level, its 2011 low. Its weekly and daily RSI are bearish and pointing lower supporting this view.

Alternatively, a break and hold above the 82.21 level must occur for USDJPY to to halt its present weakness and resume its recovery strength started from the 79.57 level. This will bring further gains towards the 83.27 level, its April 18’2011 high with a loss of that level allowing for more gains towards the 85.49 level, its April’2011 high.