“¢ Resurgent USD demand prompts some fresh selling during the European session.

“¢ A modest recovery in US equity markets did little to support safe-haven demand.

Gold extended its steady decline from an intraday high, around $1221 area, and is currently placed at the lower end of its daily trading range, or two-week lows.

The Fed’s upbeat outlook for the domestic economy, reaffirming expectations for at least two more rate hikes by the end of this year, capped the early attempted recovery move for the non-yielding yellow metal. Adding to this, a fresh wave of US Dollar upsurge prompted some fresh selling around the dollar-denominated commodity since the early European session.

Meanwhile, a goodish rebound in the US equity markets, with all the three major indices recovering a part of the early slump, now seemed to exert some additional downward pressure on the precious metal’s safe-haven appeal.

Further downside, however, remained cushioned as investors now seemed to refrain from placing aggressive bets ahead of Friday’s highly anticipated US monthly jobs report, popularly known as NFP, which is known to infuse volatility across global financial markets.

Technical Analysis

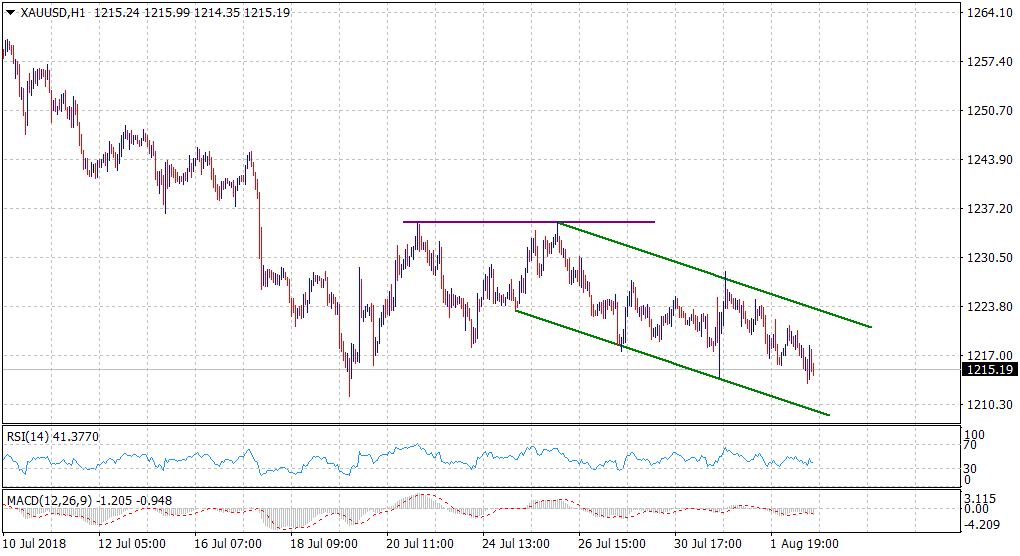

From a technical perspective, the commodity has been trending lower alongside a descending trend-channel over the past one-week or so. This coupled with the recent rejections from $1235 area constituted towards the formation of a bearish double-top chart pattern.

Hence, the commodity remains vulnerable to extend its near-term downward trajectory back towards YTD lows, around the $1212-11 region, and any meaningful attempt recovery seems more likely to get sold into.