- Gold risk reversals show put demand is strongest since Dec. 29.

- The yellow metal is holding just above 50-month MA, eyes Powell testimony.

Gold one-month 25 delta risk reversals fell to -0.55 today – the lowest level since December 29, highlighting strong put demand ahead of Fed’s Powell’s testimony to congress.

The September rate hike has been baked-in and the markets will likely start pricing-in a December rate hike if the Fed head downplays risks to economy from Trump’s trade war and expresses concerns over rising inflation.

In this case, USD could pick up a strong bid, pushing gold below the 50-month MA of $1,235. The yellow metal has already witnessed a long-run bearish revival last week. Further, strong demand for gold puts indicates the investors are likely expecting Powell to sound hawkish and hence are seeking downside protection (put options).

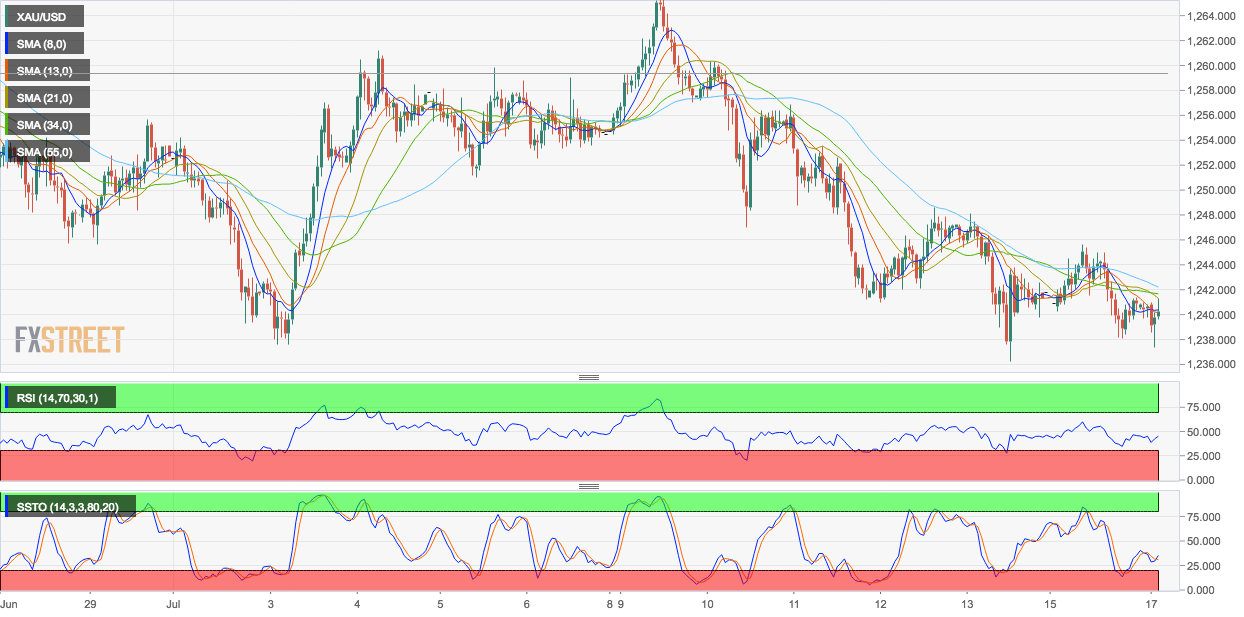

That said, signs of short-term bearish exhaustion around $1,238 seen on the hourly chart indicate scope for a minor corrective rally.

Hourly chart

Current Price: $1,240

Daily High: $1,241.30

Daily Low: $1,237.67

Trend: Corrective rally likely, overall bearish

Resistance

R1: $1,245 (8-day EMA)

R2: $1,261 (June 21 low)

R3: $1,265.90 (July 7 high)

Support

S1: $1,234 (50-month MA)

S2: $1,205 (July 2017 low)

S3: 41,200 (psychological hurdle)