“¢ A modest pickup in the USD demand prompts some fresh selling.

“¢ Positive European equity markets add to the downward pressure.

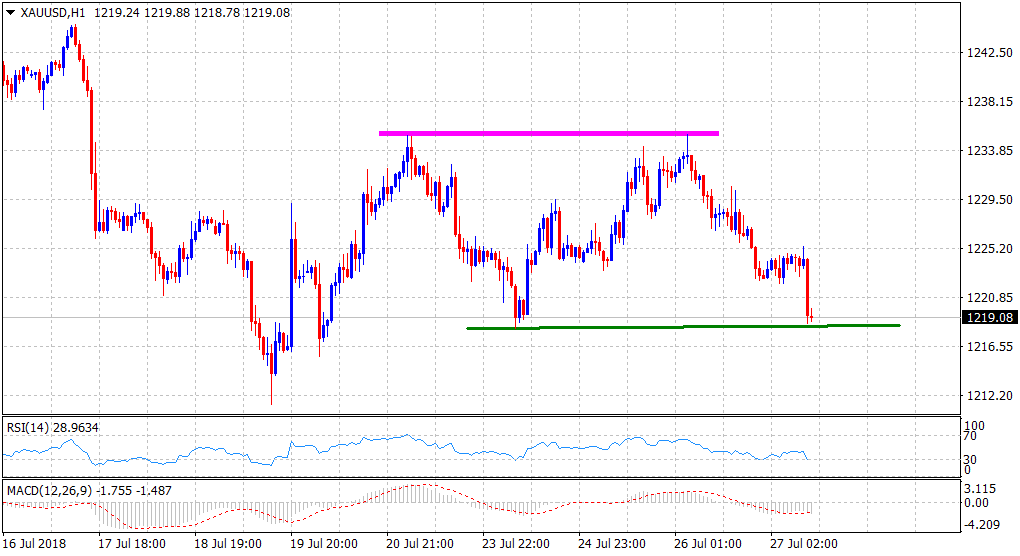

After an initial uptick to $1225 area, gold met with some selling pressure and turned lower for the second consecutive session.

The precious metal extended overnight retracement slide from $1235 horizontal resistance and was now being weighed down by a combination of negative factors. A fresh wave of US Dollar buying since the early European session prompted some fresh selling around dollar-denominated commodities – like gold.

This coupled with buoyant trading sentiment across European equity markets weighed on traditional safe-haven assets and further collaborated towards exerting some additional downward pressure on the precious metal.

Meanwhile, a subdued action around the US Treasury bond yields did little to influence the price action, albeit firming Fed rate hike expectations might keep a lid on the non-yielding yellow metal’s any meaningful recovery attempts.

Later during the early North-American session, the release of advance US Q2 GDP growth figures will be looked upon to grab some short-term trading opportunities on the last day of the week.

Technical Analysis

Previous session’s rejection slide from $1235 zone now seems to have constituted towards the formation of a bearish double-top chart pattern on the 1-hourly chart.

A follow-through weakness below weekly lows support near $1218 area would confirm the bearish pattern and turn the metal vulnerable to head back towards retesting YTD lows, around the $1212-11 region.