“¢ Reviving safe-haven demand helped gain some positive traction earlier.

“¢ Gradual Fed rate hike prospects kept a lid on any meaningful up-move.

“¢ Resurgent USD demand prompts fresh selling over the past couple of hours.

Gold reversed a major part of its early recovery gains but has still managed to hold with modest daily gains, around the $1218-17 region.

Reemerging US-China trade war fears triggered global risk-aversion trade and was reinforced by a sea of red across equity markets. The global flight to safety underpinned the precious metal’s safe-haven demand and was seen as one of the key factors behind the early rebound during the Asian session.

The uptick, however, lacked any strong follow-through and remained capped amid prospects for a gradual Fed rate hike path, reaffirmed by the August FOMC statement, where the Fed gave an upbeat assessment on the US economy.

The Fed’s hawkish outlook continued boosting the US Dollar demand, which eventually exerted some additional downward pressure on the dollar-denominated commodity and further collaborated to the latest leg of slide over the past couple of hours or so.

Technical Analysis

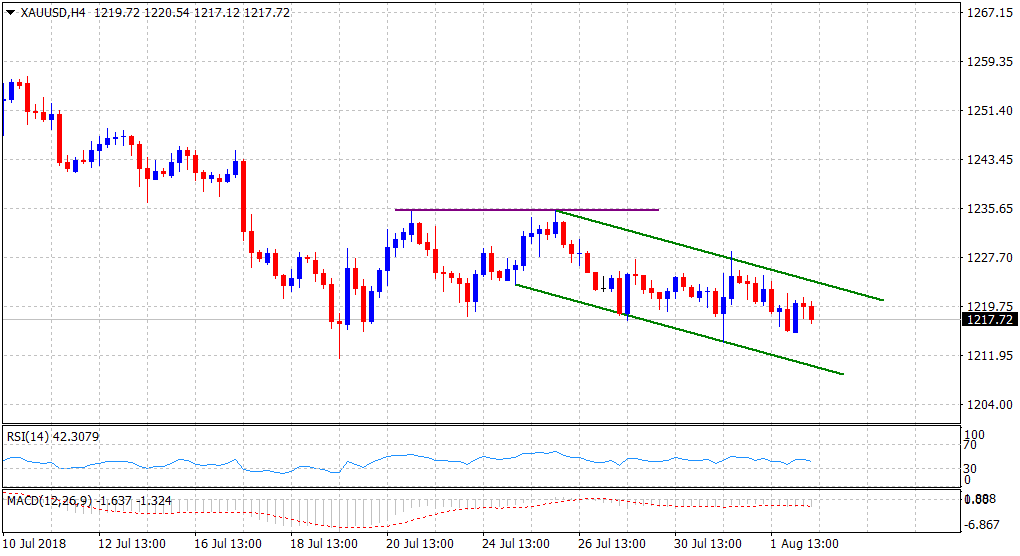

Looking at the technical picture, the commodity has been oscillating within a short-term descending trend-channel formation on the hourly charts. This coupled with the recent rejections from the $1235 supply zone seems to have formed a double top chart pattern and further adds credence to the bearish trend.

Hence, every attempted up-move might continue to confront fresh supply at higher levels. With technical indicators still holding in negative territory, an extension of the downward trajectory, back towards retesting YTD lows, around the $1212-11 area, remains a distinct possibility.