“¢ Struggles to build on overnight rebound, despite a combination of supporting factors.

“¢ Fed rate hike expectations now seemed to keep a lid on any meaningful up-move.

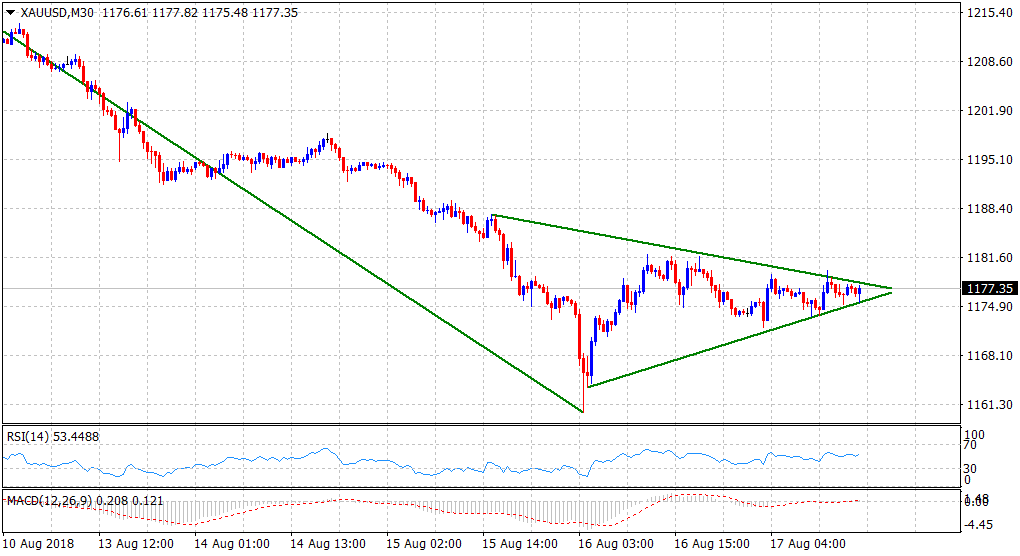

“¢ Technical set up points to further near-term downside, even from current levels.

Gold extended its consolidative price action through the mid-European session and is currently holding with modest daily gains around the $1177 region.

The commodity failed to capitalize on previous session’s goodish rebound from 19-month lows and has been oscillating in a narrow trading range over the past 24-hours or so, despite a combination of supporting factors.

The US Dollar held on the defensive on the last trading day of the week and risk-aversion seems to have come back in play, amid some fresh weakness seen in the Turkish Lira, albeit did little to provide any meaningful impetus.

Market expectations that the Fed will stick to its gradual monetary policy tightening through the end of this year seemed to be the only factor keeping a lid on any meaningful up-move for the non-yielding yellow metal.

Hence, overnight recovery might now be seen as a short-covering bounce from near-term oversold conditions, clearly suggesting that the well-established bearish trajectory might still be far from over.

Technical Analysis

The formation of a bearish continuation pattern – pennant, on the shorter time-frame adds credence to the negative outlook and thus, creates an opportunity to initiate some fresh bearish positions, even at current levels.

Having said that, a sustained move beyond $1180 level might negate the bearish bias and trigger a near-term short-covering bounce and lift the commodity further towards testing $1191-92 supply zone en-route the $1200 handle.