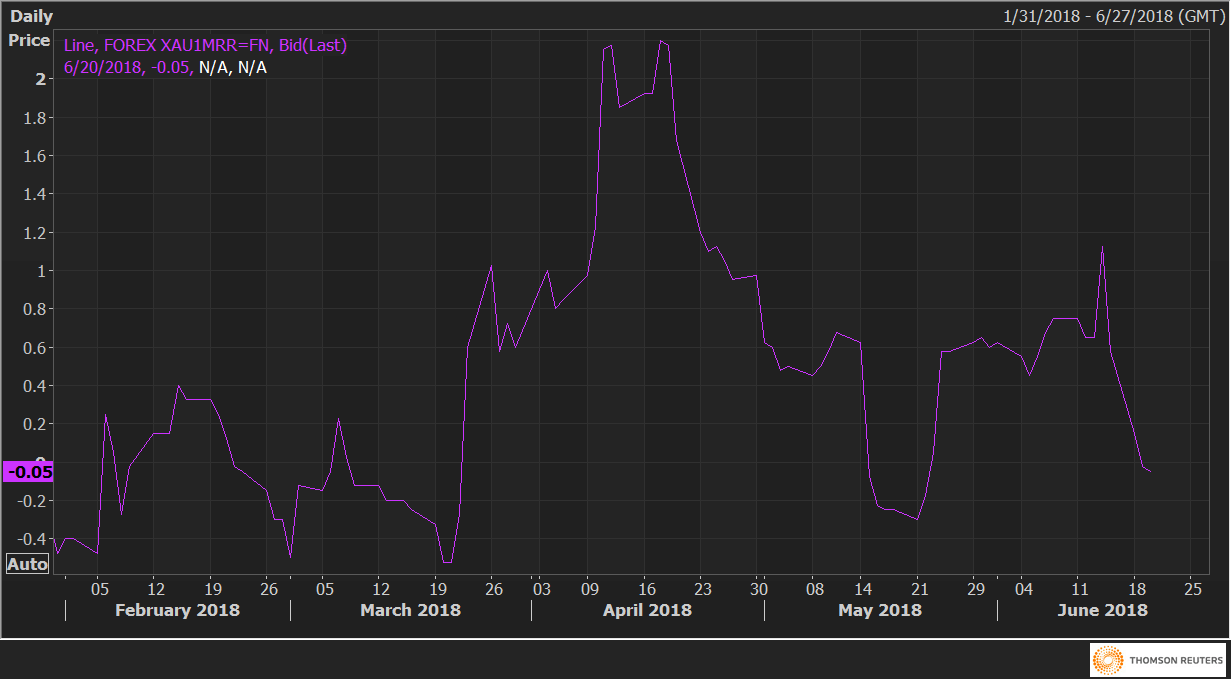

- Gold (XAU/USD) risk reversals fell to -0.05 today – the lowest level since May 22.

- Highlights demand for XAU puts outstrips demand for XAU calls in the options market.

Gold one-month 25 delta risk reversals (XAU1MRR) are being paid at 0.05 XAU puts – the level last traded on May 22, vs 1.13 XAU calls on May 14.

The shift from call bias to put bias as indicated by the drop in the risk reversals from 1.13 (call bias) to -0.05 (put bias) adds credence to gold’s drop to 2018 low of $1,275 and indicates the investors are likely expecting a deeper drop in metal and hence are seeking downside protection (put options).

The yellow metal is seen falling to $1,240 in a week or two, according to technical studies.

XAU1MRR