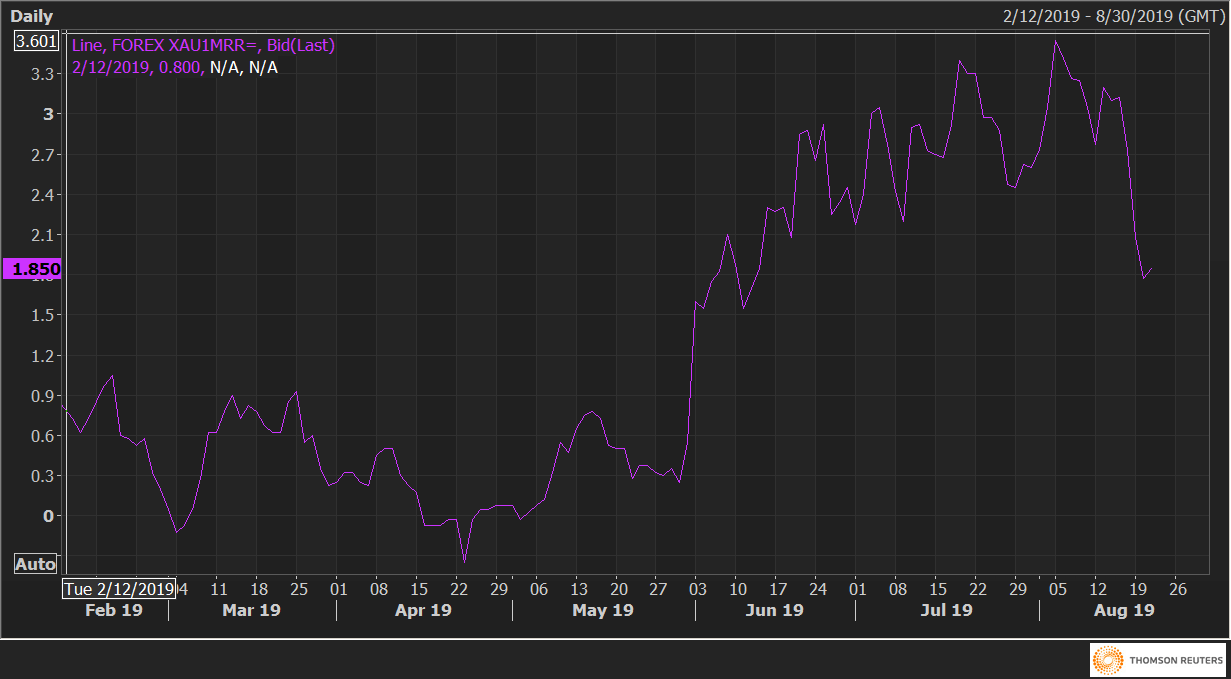

- Risk reversals on Gold hit the lowest level since June 12.

- The drop in the risk reversals indicates weakening demand for call options.

The implied volatility premium for the bullish bets on gold or call options has dropped sharply over the last two weeks, a sign the investors are expecting a correction in the yellow metal.

One-month risk reversals (XAU1MRR) on gold, a gauge of calls to puts on the safe-haven metal, fell to 1.775 on Tuesday, the lowest level since June 12, having topped out at 3.55 on Aug. 5. At press time, the gauge is seen at 1.85.

The retreat from 3.55 to 1.775 represents a drop in demand or implied volatility premium for call options.

The data reinforces the case for a pullback to $1,480 put forward by Gold’s technical charts. As of now, the yellow metal is changing hands at $1,501.

XAU1MRR