GOLD traded lower recently as sellers got control and took prices towards the $1228 level. The recent releases in the US were on the positive side, which pushed GOLD lower. Today, there are no major releases lined up in the US. The only low risk event lined up is the US MBA Mortgage Applications, which will be released by the Mortgage Bankers Association. Let us see how the outcome shapes in the coming sessions, as the last reading was 1.3%. There is no doubt that GOLD is under severe pressure and might trade lower in the coming sessions.

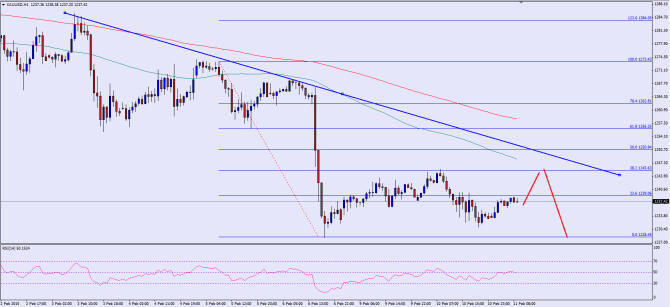

There is a monster bearish trend line formed on the hourly chart of GOLD, which might act as a major barrier for GOLD in the near term. The 100 hour simple moving average is also sitting around the same trend line. Moreover, the 38.2% fib retracement level of the last drop from the $1273 high to $1228 low is also around the same area. In short, there is a major resistance formed around the $1245 level which can be considered as a pivot point moving ahead. If GOLD moves higher from the current levels, then sellers might take a stand around the 100 hour MA. A break above the same might call for a move towards the 200 hour moving average.

On the downside, initial support is around the last low of $1228. A break below the same might call a move towards the $1210 level.

Overall, one might consider selling rallies in GOLD as long as it is trading below the 100 hour MA and trend line.

————————————-

Posted By Simon Ji of IKOFX Technical Team: Online Forex Broker

Website: http://ikofx.com/

In our latest podcast, we do an Aussie Analysis, Greek Grindings and Oil Optimism.