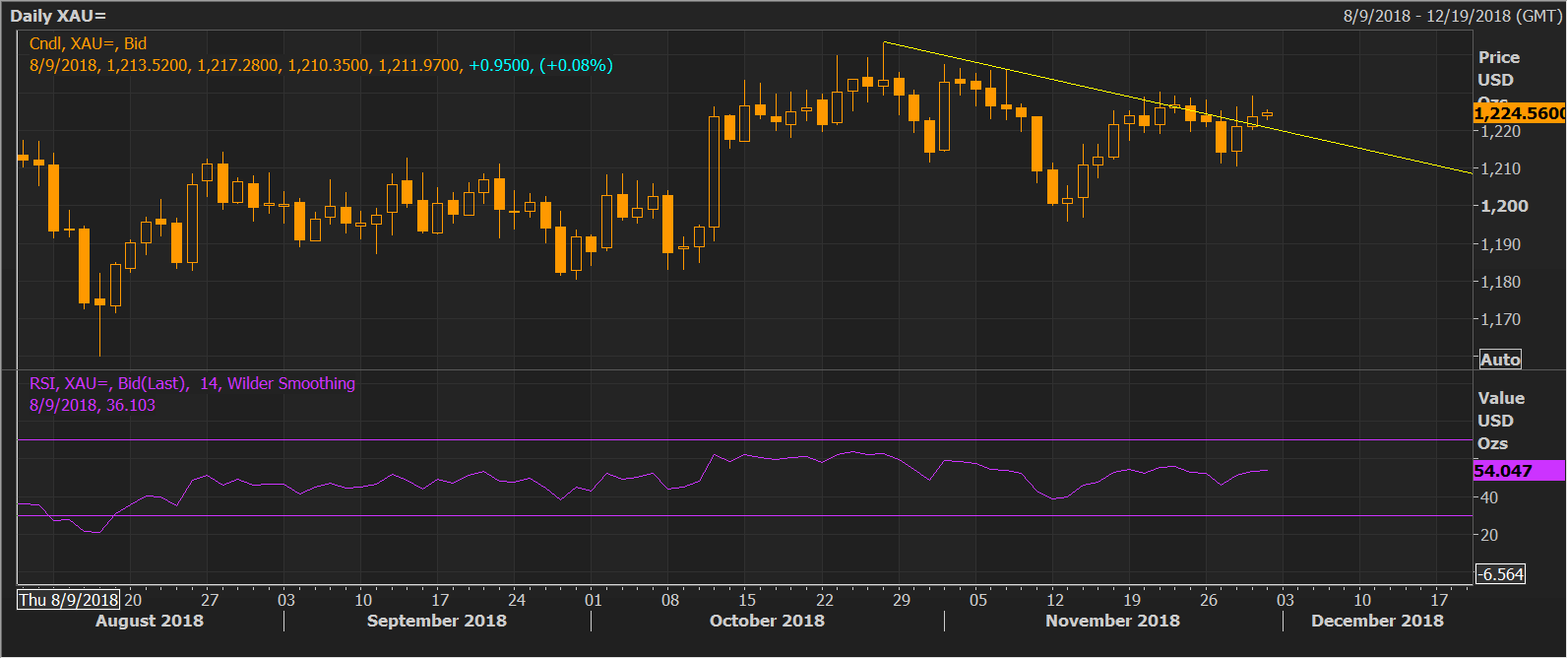

- Gold has crossed the trendline falling from, the Oct. 26 and Nov. 7 lows. The bull breakout, however, would be confirmed above the horizontal resistance at $1,230 (Nov. 21 high).

Daily chart

- As can be seen above, the yellow metal closed at $1,223 yesterday, confirming an upside break of the falling trendline resistance. The long upper shadow of yesterday’s candle, however, takes the shine off the bullish breakout, as it likely represents selling pressure near the key resistance at $1,230.

- As a result, a break above that level is needed to put the bulls back into the driver’s seat.

- The 14-day relative strength index (RSI) is reporting bullish conditions above 50.00. Further, Fed’s dovish turn may have put the greenback on the path to deeper losses. So, a break above $1,230 could happen soon.

- The prospects of bull breakout, however, would weaken sharply, if gold prices find acceptance below yesterday’s low of $1,230.

Trend: Cautiously bullish

XAU/USD

Overview:

Today Last Price: 1225.16

Today Daily change: 1.1e+2 pips

Today Daily change %: 0.0915%

Today Daily Open: 1224.04

Trends:

Previous Daily SMA20: 1217.42

Previous Daily SMA50: 1219.75

Previous Daily SMA100: 1208.44

Previous Daily SMA200: 1235.01

Levels:

Previous Daily High: 1228.9

Previous Daily Low: 1220.3

Previous Weekly High: 1230.3

Previous Weekly Low: 1217.7

Previous Monthly High: 1243.43

Previous Monthly Low: 1182.54

Previous Daily Fibonacci 38.2%: 1225.62

Previous Daily Fibonacci 61.8%: 1223.59

Previous Daily Pivot Point S1: 1219.93

Previous Daily Pivot Point S2: 1215.82

Previous Daily Pivot Point S3: 1211.34

Previous Daily Pivot Point R1: 1228.53

Previous Daily Pivot Point R2: 1233.01

Previous Daily Pivot Point R3: 1237.12