- Gold buyers catch a breath near key resistance confluence, after a rise.

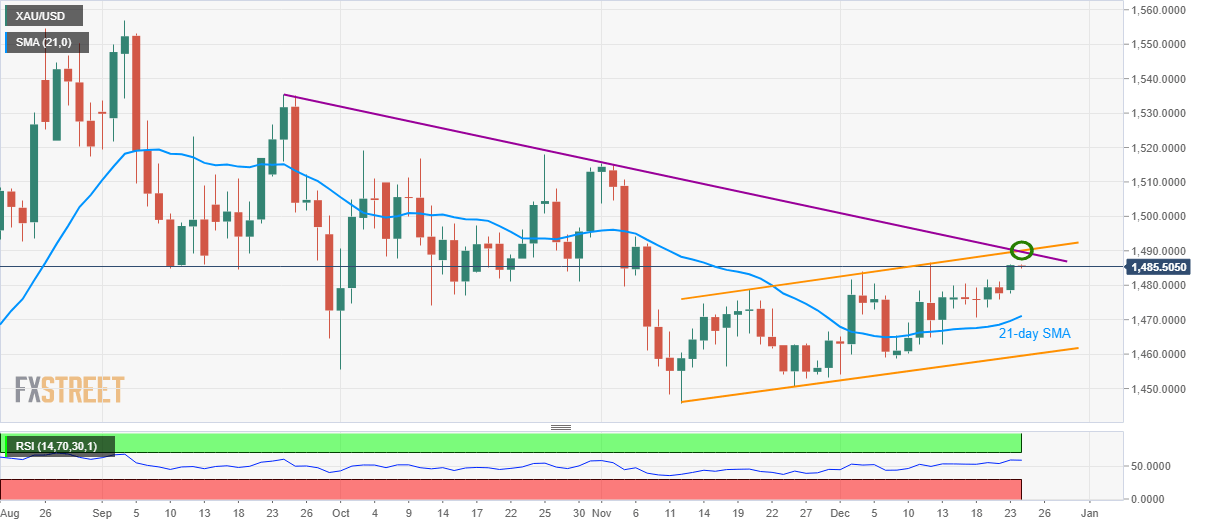

- A confluence of the three-month-old falling trend line and the upper line of the five-week long ascending channel in focus.

- 21-DMA acts as immediate support.

Gold prices stay mildly bid near right-day high while flashing $1,485.50 as the quote during early Tuesday. The bullion nears the short-term key resistance confluence after Monday’s heavy rise.

A multi-month-old descending trend line and an upper line of short-term rising channel offer the key resistance around $1,490, the same holds the key to metal’s run-up towards $1,500 and the November month top near 1,515.

Meanwhile, the likely pullback can take the rest of 21-Day Simple Moving Average (DMA), at $1,471 now, ahead of highlighting the channel’s support line of $1,459.

Although odds are high that the safe-haven will bounce off $1,459, an extended decline will drive bears towards the November month low near $1,446/45.

Gold daily chart

Trend: Pullback expected