“¢ The commodity falls to fresh YTD lows and was being weighed down by a combination of negative factors – broad-based USD strength, Fed rate hike expectations, risk-on mood.

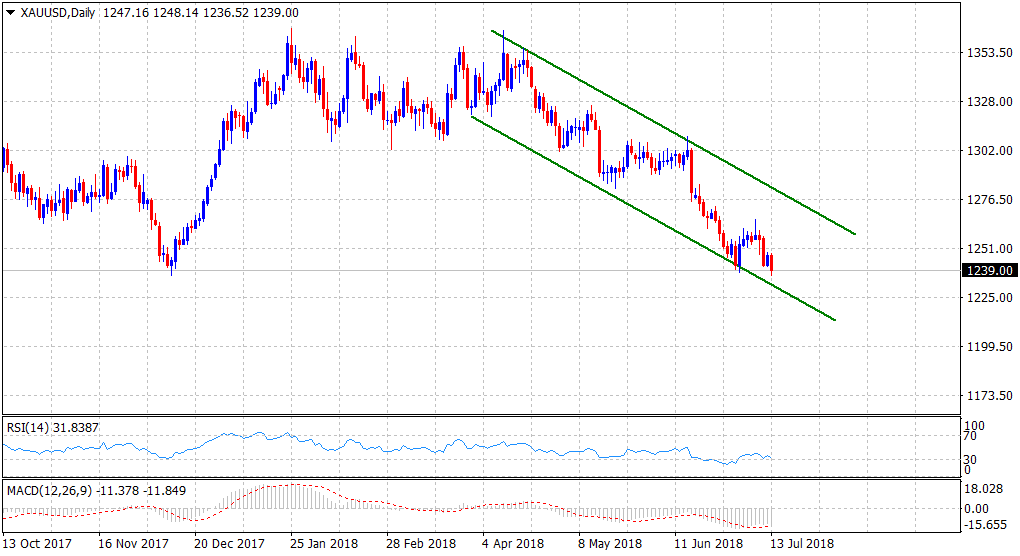

“¢ The downfall has been alongside a downward sloping trend-channel formation on the daily chart and points to a continuation of the bearish trajectory.

“¢ With short-term technical indicators gradually drifting towards near-term oversold conditions, bears are likely to pause near the trend-channel support, also coinciding with 200-week SMA.

Spot rate: 1238.29

Daily High: 1248.14

Daily Low: 1236.52

Trend: Bearish

Resistance

R1: $1241 (horizontal level)

R2: $1248 (current day swing high)

R3: $1252 (previous YTD weekly closing low)

Support

S1: $1236.52 (current day swing low)

S2: $1234 (200-week SMA/descending trend-channel)

S3: $1229 (horizontal level)