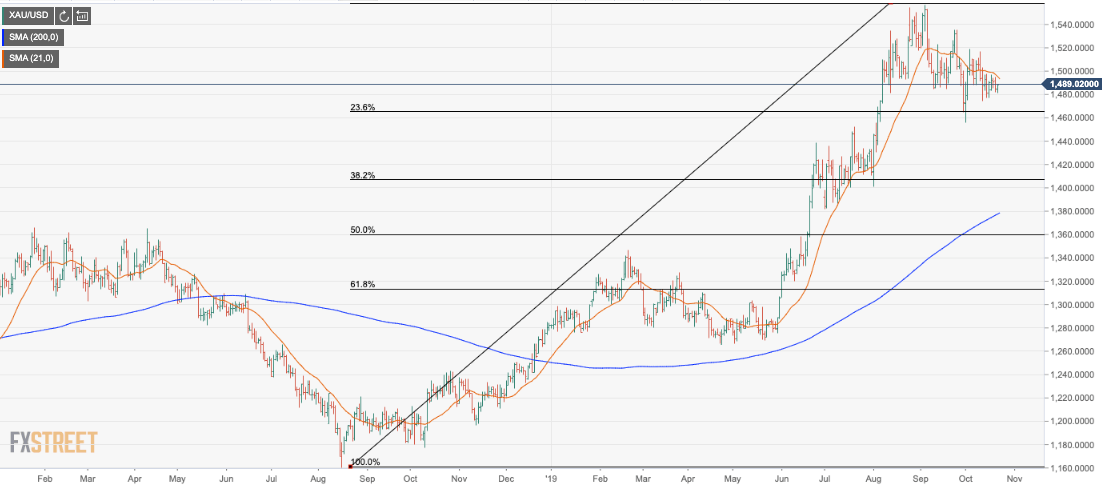

- Gold is squashed between a 23.6% Fibo and the 21-DMA.

- Gold bears eyeing a break to a 50% mean reversion.

Gold prices are consolidated between a 23.6% Fibonacci retracement level and the 21-day moving average. At this juncture, should the bulls continue to fail below 1500, a slide to the downside is the most likely path of least resistance.

A 50% mean reversion of the late June swing lows to recent highs level around 1460/70 remains compelling. However, should the bulls break above the 50-DMA on a closing basis, then a subsequent advance beyond the psychological 1500 level ahead of the 1520 area will open prospects for a test back to the key 1535 resistance target.

Gold daily chart