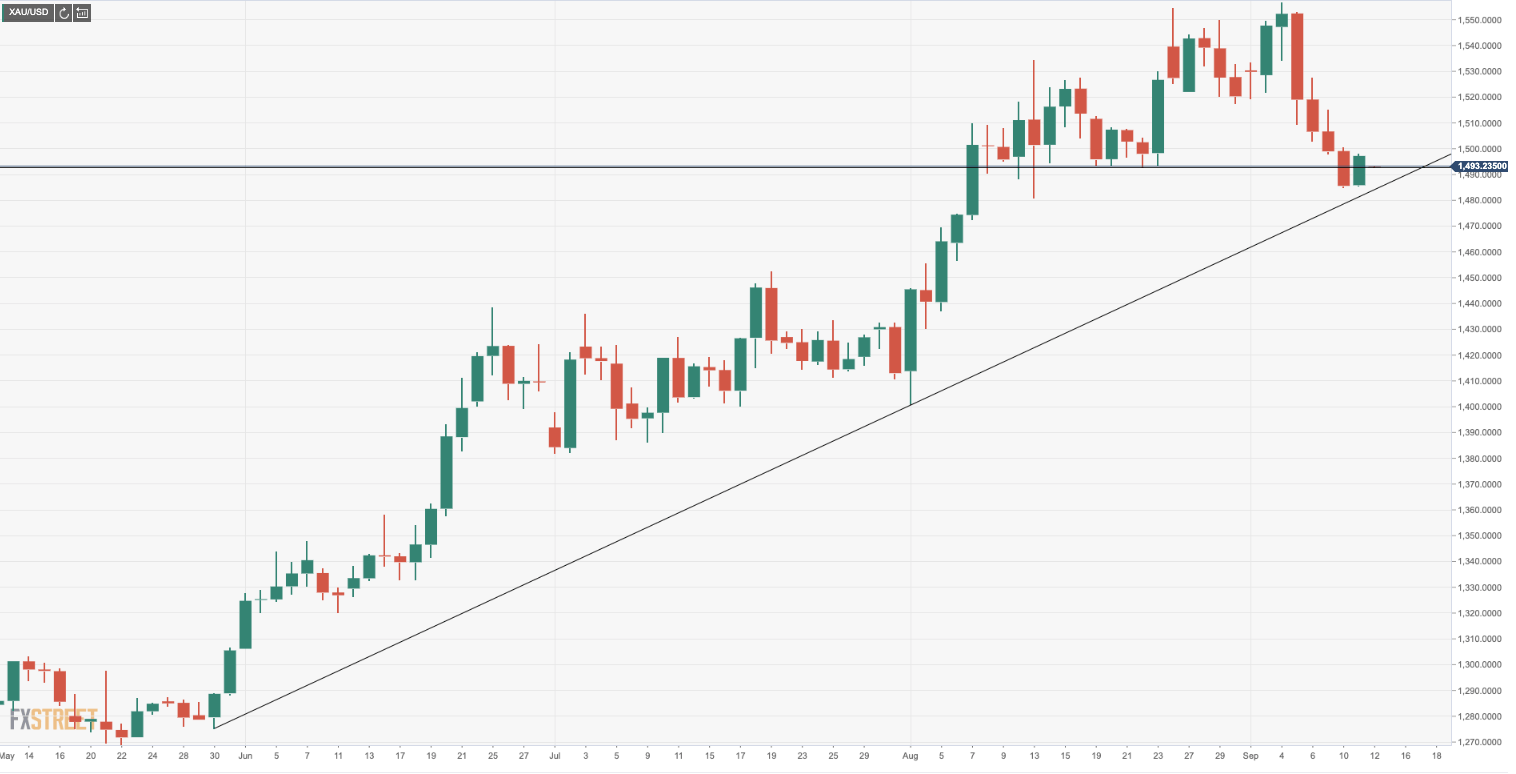

- Gold is below the 21-day moving average, on verge of a test of trendline support.

- On the flipside, Bulls will need to get back above 1,550.

Gold remains heavy despite the bottoming signals below the 1,500s. The August support line has been broken but bears are not committing to short positions, likely as geopolitical uncertainties remain on the boil.

Gold is below the 21-day moving average, (bearish) while pressing on the 23.6% Fibonacci (Fibo) retracement of the July lows to recent swing highs. Below the trendline support, 1,478, as the 13 August volatility spike low, guards the 19 July swing highs that are located at 1,452.93. On the flipside, Bulls will need to get back above 1,550 which then guards prospects for 1,590 as the 127.2% Fibo target area.

Gold daily chart