- Gold trades a shade lower than the $1330 during the early Asian session on Wednesday.

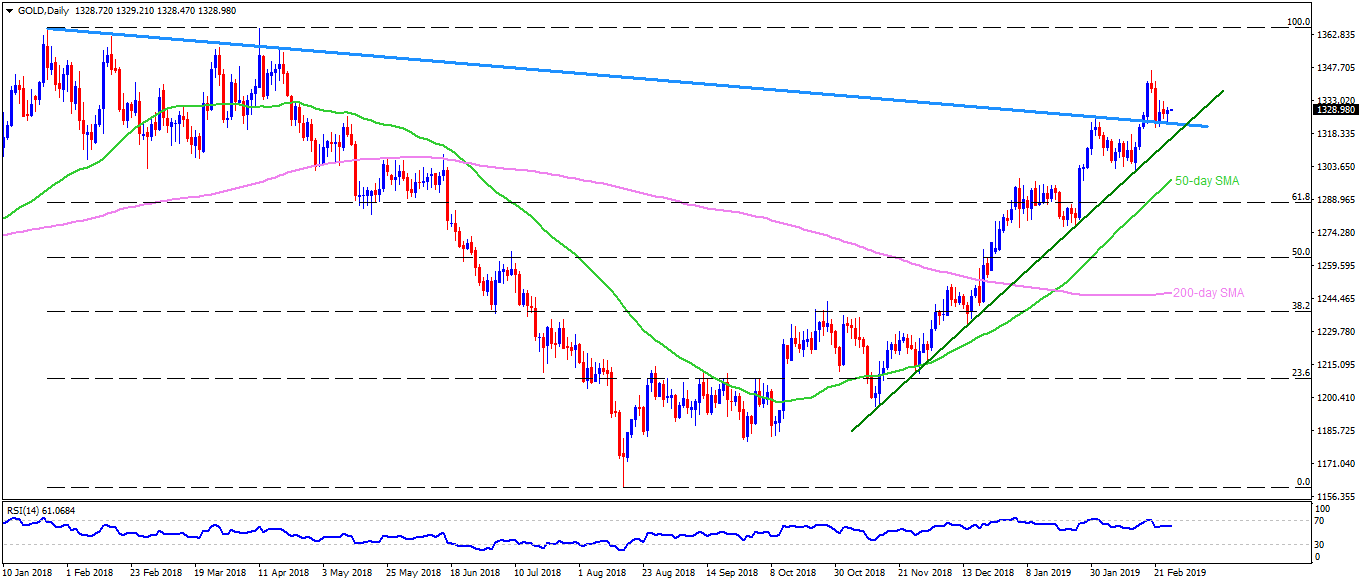

- On Tuesday, the bullion bounced off the thirteen-month-old descending trend-line support, previously acting as a resistance.

- Considering the recent U-turn and a gradual increase in 14-day relative strength index (RSI), the quote is likely to revisit $1334, $1337 and $1346 nearby resistances.

- In case buyers continue dominating past-$1346, $1357, $1362 and $1366 might appear on their radar.

- Given the precious metal’s slide under $1322 support-line, an upward sloping trend-line at $1316 that joins lows marked since November 2018 becomes crucial for the traders.

- Should there be a daily closing under $1316, $1302 and 50-day simple moving average (SMA) figure of $1297.85 may please the sellers.

Gold daily chart

XAU/USD

Overview:

Today Last Price: 1328.81

Today Daily change: 1.69 pips

Today Daily change %: 0.13%

Today Daily Open: 1327.12

Trends:

Daily SMA20: 1319.06

Daily SMA50: 1295.9

Daily SMA100: 1261.29

Daily SMA200: 1234.89

Levels:

Previous Daily High: 1332.58

Previous Daily Low: 1325.32

Previous Weekly High: 1346.85

Previous Weekly Low: 1320.72

Previous Monthly High: 1326.25

Previous Monthly Low: 1275.9

Daily Fibonacci 38.2%: 1328.1

Daily Fibonacci 61.8%: 1329.81

Daily Pivot Point S1: 1324.11

Daily Pivot Point S2: 1321.09

Daily Pivot Point S3: 1316.85

Daily Pivot Point R1: 1331.36

Daily Pivot Point R2: 1335.6

Daily Pivot Point R3: 1338.62