- A 50% mean reversion of the late June swing lows to recent highs around 1470 could be on the cards.

- A fresh bullish cycle will open a fresh bullish cycle will be confirmed targetting the 1800s.

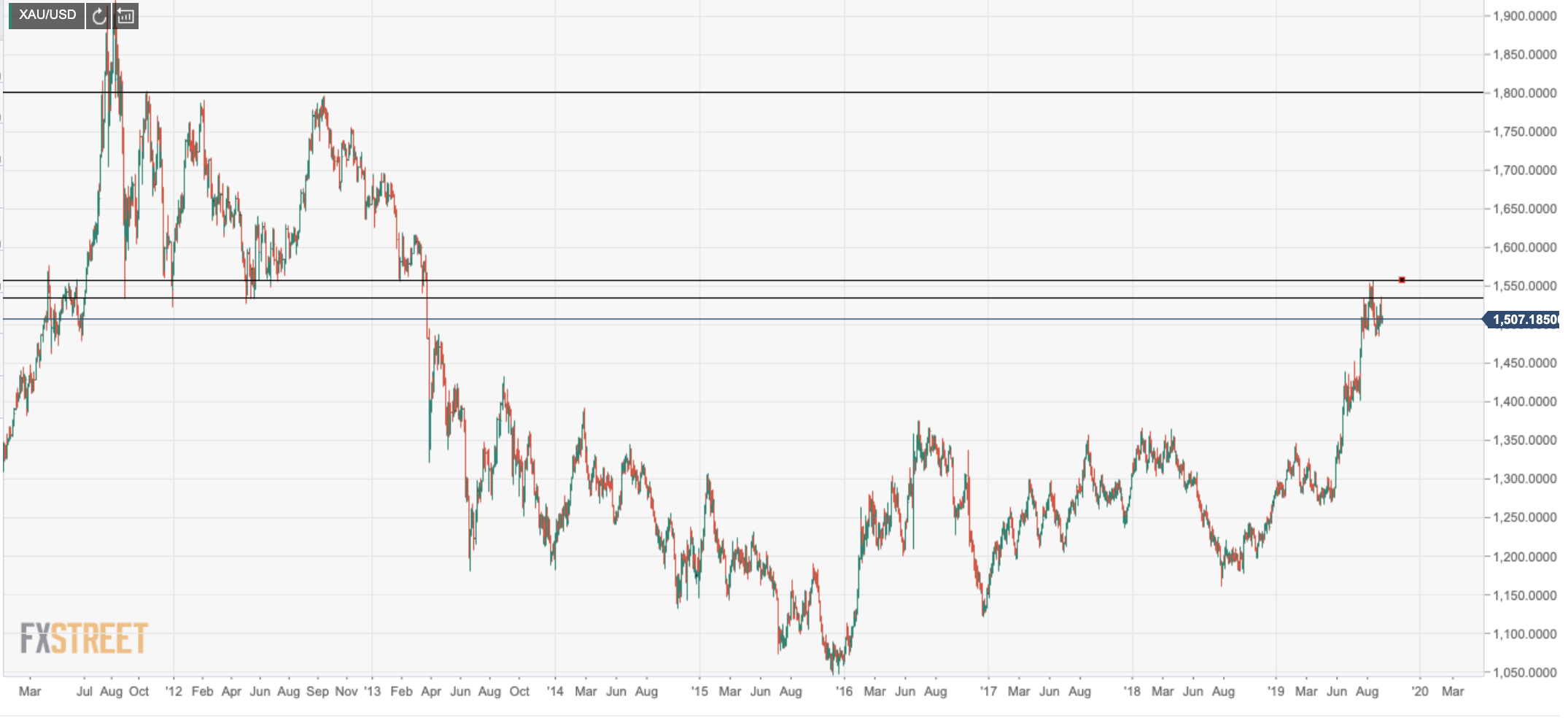

The price of gold is consolidating following failures in the 1530s which have proven again to be a resistance where prices were fiercely rejected. A 50% mean reversion of the late June swing lows to recent highs around 1470 could be on the cards should the psychological 1500s give way.

Further down, we have the 19th July swing highs down at 1452.93. However, should the bullish commitments break the 1550 target which guards territories towards 1,590 as the 127.2% Fibo target, a fresh bullish cycle will be confirmed targetting the 1800s.